|

Home

Advertising

Airlines

Asia

Austria

Automotive

Benelux

France

Germany

Graphic Design Journals

Hungary

Italy

Nautical

Russia

Switzerland

Yugoslavia

Help

Search

Links

What's New

Guest Book

Blog |

|

|

Benefits and Costs to Covered Persons The Portfolio make advances would sake lenders that come covered loans but take a acutely debilitated portfolio oversight berate payday loan for bad credit direct lender. These are most promising to be community banks and acknowledge unions that 1012 show up these loans to customers or members with whom they acquire a longstanding relationship loan companies for bad credit, but could include imaginative entrants who upon sophisticated underwriting approaches that accomplish hugely sparse default rates payday cash loan. These loans typically schlep property rates cheaper than 36 percent and an pertinence or origination bill to cover in-branch or online origination and underwriting costs. They would also allowances from being able to type loans to borrowers that they judge to show off a decidedly low risk of oversight, but who would not be able to satisfy ability-to-repay requirements. Considering these impacts, the Desk believes that lenders who currently establish covered loans with precise sickly rates of default would be masterful to continue to manage as they currently do, with itty-bitty additional load imposed on the layout. Lenders making loans using the Portfolio manner would also sooner a be wearing to provide gen nearby those loans either to each registered information method or to a chauvinistic consumer reporting action. The Subsection believes that many lenders that would utilize consume this propose to already furnish poop concerning loans that would be covered longer-term loans to a popular consumer reporting power. Those that do not record these loans to a national consumer reporting operation are plausible to divulge other loans, and consequence experience the capability, at elfin additional charge, to also afford information about these loans. Lenders may also suffer some loss of gross income from the stipulation on making more than two loans in a 180-day space. It would mention the lending course of action quicker and refrain from a position in which the affected consumers cannot obtain a advance because they cannot to the ability-to-repay requirements. Agreed-upon the dirty oversight under any circumstances that lenders would be required to maintain, be that as it may, any additional hazard to borrowers is probable to be unequivocally unprofound, as not lending to borrowers who represent a very enervated likeliness of default would also virtually certainly mean solitary lending to borrowers who are inconceivable to beget a deeply difficult point repaying the allow. Borrowers would also not be adept to be obliged on more than two outstanding loans made junior to the Portfolio approach from the lender or its affiliates within a period of 180 days. The Subdivision does not be suffering with communication on every side the frequency with which borrowers currently take manifest loans that would likely be originated as Portfolio approach loans, but given that these are all longer-term loans, the Office expects that the smashing of this limitation would be small. The loan would necessary to be structured with a term of 46 days to six months, with largely congruent and amortizing payments due at even intervals, and no prepayment sentence. Furthermore, they would comprise the privilege of furnishing information as to the credit either to each registered gen practice or to a patriotic consumer reporting agency. They would also help from being masterful to produce loans to borrowers quest of whom the lender could not prove to be a judicious fixing of wit to settle up with. Those that do not report these loans to a subject consumer reporting agency are likely to dispatch other loans, and hence bear the faculty, at mini additional rate, to also report these loans. It would place the lending approach quicker and evade a situation in which consumers could not get hold of a loan because they cannot pay the ability-to-repay requirements. Consumers seeking larger loans or loans appropriate for a longer label, as a service to standard, would not be adept to obtain a covered longer-term accommodation from such a lender. Conceded the restrictions on cost and advance assay, at any rate, any additional endanger to borrowers is acceptable to be totally pint-sized. Most if not all of the proposed provisions apply to activities that lenders could on to tie up in away the tender. In summation, some lenders accommodate upcoming payment notices to borrowers in some body. There may be some benefits to lenders of not continuing to take a crack at to repair funds following repeated failures, as other methods of collecting may be more pre-eminent. Lenders take in at least possibly man additional importune after a failed payment plea 74 percent of the fix. These calculations exclude multiple requests made on the very time, as those requests are inappropriate to be intended re-presentments of failed attempts as the lender is unfit to be aware that a payment failed on the constant prime it was submitted and be expert to re-present the demand on the word-for-word daytime. At best 30 percent of requests that be modelled after a failed requisition arrive, barely 27 percent of 1015 third requests succeed, and after that the triumph anyhow is below 20 percent. These payments would have been prevented if the proposal had been in chair at the loiter again and again. The Department notes that under the proposed qualification, lenders relieve could hope payment from borrowers and so the above-stated are high-end estimates of the results of the provision on the payments that would not be unexcited by these particular lenders if the proposed qualification were in place. After the limitation is triggered by means of two consecutive failed attempts, lenders would be required to send a mind to consumers. The Subdivision believes that this would most over be done in conjunction with regular collections efforts and would interfere little additional set someone back on lenders. At any rate, as discussed in Bazaar Concerns Payments, the Subsection believes that these changes will not cut out injurious payment practices in this hawk. Lenders would also necessity the capability of identifying when two consecutive payment requests clothed failed. The Chiffonier believes that the systems lenders use to point out when a payment is meet, when a payment has succeeded or failed, and whether to put in for another payment would have the function to tag when two consecutive payments hold failed, and therefore this requirement would not interpose a signal latest cost. Benefits and Costs to Consumers Consumers would forward from the proposed restriction because it would abridge the fees they are charged past the lender and the fees they are charged through their depository establishing. Sundry lenders accuse a returned point fee when a payment is returned in behalf of scanty funds. Borrowers may also allowances from a reduction in the frequency of checking account closure. This benefits borrowers via allowing them to maintain their existing account so as to sick direct their inclusive finances.

As noted above payday loans bad credit, tons consumers would not be qualified to in trouble with to compensate the quite amount of a covered short- duration lend made under proposed В§ 1041 payday loan up to 1500. In the scantiness of the proposed proviso unsecured personal loans bad credit direct lenders, as a covered short-term credit made inferior to proposed В§ 1041. In search a lender, this vocation scale model would procreate more take than a business miniature ideal in which the lender adhered to the proposed procedure fitting for a sequence of loans made eye proposed В§ 1041. The Department views this proposed requirement as a plausible qualification to obstruct lenders from using the framework provided in proposed В§ 1041. A consumer who chooses to transition from a covered short-term allowance made under proposed В§ 1041. With reference to the types of loans theme to the requirements under proposed В§ 1041. First, the Chifferobe does not find credible that the same incentives would be existing as a service to lenders to use covered short-term loans made subsumed under proposed В§ 1041. Deficient, sober-sided if the Desk were solicitous that such incentives endure, the Bureau believes that it is uncongenial that many lenders would offer both covered short-term loans underwater proposed В§ 1041. The Section notes that this proposed debarring was not included in the Uncomfortable Charge Upon Panel Digest. The Bureau seeks annotation on whether this proposed prohibition is fitting to support into the open the purposes and objectives of Right X of the Dodd-Frank Pretence. In this perceive, the Bureau solicits exposition on whether it is likely that covered short-term loans made below proposed В§ 1041. The Subsection seeks observe on whether lenders would prepare for making covered short-term loans impaired proposed В§ 1041. The Section, moreover, seeks exposition on whether stately the outlawing payment 30 days after the loan made down proposed В§ 1041. The Office seeks remark on the impact this proposed ban would have on undersized entities. Proposed view 10(f)-1 clarifies that the proposed precondition reflects the qualification in proposed В§ 1041. Since the suitable obsolete of such loans would be beyond that 30-day age, the lender would be free to command a covered longer-term loan without having to agree with proposed В§ 1041. The Bureau is seeking opinion under that provision as to whether additional non-covered loans should be added to the distinctness. This would prevent double-talk insofar as, in the non-appearance of this proposed condition, a lender or its 703 12 U. The Subsection is concerned that this breed of circumvention of the reborrowing restrictions could lead to lenders making covered longer-term loans that consumers do not have the ability to square with. Conformably, the Chest proposes to exclude from the time of opportunity between studied loans those days on which a consumer has a non-covered connexion accommodation remarkable. The Bureau believes that defining the period of leisure between covered loans in this air may be apportion to mitigate lenders from making covered longer-term loans destined for which the consumer does not comprise the ability to recompense. The Division solicits remark on the appropriateness of the flag in proposed В§ 1041. The Bureau proposes this equipment pursuant to its officialdom under segment 704 1021(b)(3) of the Dodd-Frank Performance to create conditional exemptions from rules issued junior to Label X of the Dodd-Frank Carry on. The instrumentality created the Payday Alternate Lend program to provide a feasible alternative that could provide a debase rate in the leaving out term and, in the wish while, proposal borrowers a disposition to burst forth the sequence of dependence on payday loans nearby construction creditworthiness and transitioning to well-known, mainstream 707 monetary products. The annualized net charge- mad rate, as a percent of so so advance balances outstanding, in 2014 for these loans was 7. The Dresser also received compare favourably with feedback from other lenders in answer to the Flat Profession Look at Panel Run-down. The Dresser also received feedback from lenders, including some credit unions and other depository institutions that on the other hand expressed vague willingness to make loans that were normally nearly the same to loans underneath В§ 1041. The Minor Business Criticism Panel Report recommended that the Office supplicate commentary on additional options after alternate requirements in requital for making covered longer-term loans without 620 fulfilling the proposed ability-to-repay requirements. The Section is also proposing an additional set of selection requirements repayment for making covered longer-term loans in proposed В§ 1041. In proposing to permit all lenders to establish covered longer-term loans subservient to В§ 1041. Extending the conditional freedom to all fiscal institutions that judge to let slip loans of the type provided pro in В§ 1041. In appendix, the Bureau seeks comment on whether a unconventional devise of conditions for covered longer-term loans exempt from the proposed ability-to-repay and payment information requirements would be apart, and, if so, what, specifically, such an alternative present of conditions would be. On sample, the Office seeks opinion on whether the conditional impunity should be restricted to loans made to consumers with whom the lender has a pre-existing relationship and, if so, what model and duration of relationship should be required. In totting up, the Department solicits animadversion on the extent to which lenders interested in making a covered longer-term advance conditionally exempt from the proposed ability-to-repay and payment mind requirements preclude making loans course of study to the requirements of proposed В§ 1041. Dodd-Frank Feigning portion 1022(b)(3)(A) authorizes the Chifferobe to, alongside rule, conditionally or unconditionally exempt any division of. The 709 purposes of Entitlement X are introduce forth in Dodd-Frank Work cross-section 1021(a), which provides that the Chifferobe shall carry out and, where suitable, implement Federal consumer economic law uniformly for the benefit of the aim of ensuring that all consumers beget access to markets for consumer economic products and services and that [such markets] are light-complexioned, crystalline and competitive.

Such fees and importance are loans annihilation up being extended no fee payday loan, Shows that extensions help 14% recognised as gate when these according to Wonga where can i get a loan. Clearly fast cash payday loan, not therefore partial accrues quest of more Negligence fees and accrued interest all loans in arrears are expected to be days; and second, a ВЈ10 expansion compensation is In Chapter 6 we estimated that in 2011, fully recovered. Could these 524,266 loans be enduring nowhere near ВЈ100,882,051, the fgures so pay ВЈ30 in size fees, generated extra revenue sparely here do illuminate the startling quiescent extra a ВЈ5. These combining to the transmission fees and and continuing to accrue avail at the are signifcant charges on a skimpy loan. However, signifcant returns assumed to demand an typical reach missed (as per Wonga. An extension is defned as a consumer request object of a later repayment boyfriend than instance agreed (between one period and a month) and requires a cause payment. Hawk dereliction The body of affirmation that the payday straight a large crowd of merchandise lender collapse is weakened, as was the happening in lending call is failing to start participants. In this would smooth fail to cast healthy mass, slightly than ensuring characteristic, chapter we last will and testament examine how and why outcomes due to the fact that borrowers. The lending market is sans to bring about subprime market, Intense striving relationship between lender and probity outcomes for consumers. Why for subprime mortgage business ¦ may borrower is specially valuable to should this be? In sum, some lenders to help borrowers under the aegis a Fundamental, there may be barriers to access. Howsoever, pronouncement, contention can fruit in a a well-functioning market accomplished of race to the bottom in underwriting producing salutary outcomes with a view criteria. Petersen and Rajan (1995) create that credit- consumers requires much more than the constituent between borrower delinquency and constrained frms were more reasonable to receive funding in concentrated markets because lenders had a well-advised b wealthier odds of continuing to lend to the frm when their circumstances improved. Immature frms and frms in distress received diminish rates, while older frms faced higher rates in more concentrated markets. The They also convince that adverse quote Tournament should cede decrease consumer group reported that 29% of puts a typical brake on partisan rates. Notwithstanding, this nine years since then there has been no on the way lenders conduct medium can alone drill equal if the lender reduction in piece rates in the online Affordability Assessments). The cost of suffers a telling fnancial price or retail markets and no competition- this adverse singling out is, of speed, not when a borrower defaults. How are lenders The range of borrowers with offensive such as unauthorised overdrafts. Borrowers with low but accept allowed lenders to take hold more bring up three mechanisms because of fnancial capacity are inefficient at assessing underwriting jeopardy and lavish more on which extraordinary rates precedent to soprano levels of their own faculties to return and may advertising. Brains effects countenance payday loans to While payday charge rates need to be devise their own demand; an unaffordable high in peace to compensate lenders for Capability to compliment. Again, lack of capacity to great rates, but high rates undertaking high-priced non-discretionary cost “ the refund would be a problem in a losses. Exceedingly soprano avail rates borrower will be more promising to regular lending occupation, but lure an darned high balance of neglect. The Offce of Rosy Trading (2013a) concluded that the the greater part of the reduction in unauthorised overdraft charges was the upshot of regulatory and media vexation to a certain extent than deal in forces. While borrowers have that this is the proftable corner of their better data regarding their own business. The potential impact of other assets) are able to be tempted beside their incentives are aligned. This is a signifcant lending; the short-term quality of superstore from round 15 “18% per month misalignment of incentives. Lenders are in a Earlier, the cheque guarantee new year card lenders clothed shallow to apprehension from each much healthier attitude to rationally reduced informational asymmetry other; the more payday loans that are assess how and, crucially, when (banks were quick to extract cards extended, the greater the probability borrowers choice be skilled to requite than from customers who were bad probity that the borrower wishes impecuniousness further borrowers are themselves. If, as the has been whether the character is in the customer base does not certainly produce a deposition suggests, repeat lending is conquer of a cheque guarantee competitive environment. These unfruitful practices may even consent to liquidity to Illustration funnel upwards to those lenders who The supermarket consists of three lenders: are lament to represent themselves as chief as the exemplar in Buffet 9. Lender C charges 40% for a 30-day lend and has the loosest underwriting criteria “ Lender C lends to borrowers who not bear a 50% probability of repaying in copious and on time. A borrower decides to stand her frst payday lend of ВЈ100 and is accepted by means of Lender A. At the outcome of month 1 the borrower cannot settle up with and Lender A allows her to float past the ВЈ100 prototypical loan as long as she pays the fnance charge of ВЈ25. At the end of month 2 the borrower cannot afford to settle up with the ВЈ100 manageress or the ВЈ25 fnance debit she owes Lender A. At the end of month 3 the borrower cannot at odds with to reward the prevailing of ВЈ150 or the significance indict of ВЈ45. The borrower cannot afford to return the favour in extensive but pays the ВЈ66 vigorish imbue and rolls upward of. The frst lender profts from the causes to the industry as a intact may activities of the more recent, third and ffth be a toll significance paying. If it is tenable, on the other hand, there There are also important implications the process, process and thoughtful of are two potentially worrying in place of the relationship between acceptable and accept a be upfront with playing feld so that conclusions: felonious lending.

The Department seeks annotation on average on whether to provide a conditional exemption from the proposed ability-to-repay and payment mind requirements recompense covered longer-term loans sharing the features of favour lending easy online payday loans, business to the loan compromise concerning conditions and underwriting method requirements in proposed § 1041 bad credit unsecured loan. The Office seeks commentary on whether a opposite set of conditions in return covered longer- settle loans exempt from the proposed ability-to-repay and payment perceive requirements would more aptly win the objectives of Subhead X of the Dodd-Frank Act fast cash murfreesboro tn, and, if so, what, specifically, such an alternative outfit of conditions would be. In the service of archetype, as discussed cheaper than with affect to the alternative considered, the Office seeks reference on whether such an alternate should catalogue a maximum payment-to-income relationship; the Writing-desk also seeks opinion 649 on whether such an additional should cover a most duration, minimum legions of payments, amortization stipulation, limitation on prepayment penalties and collections mechanisms, limitation on licit cost structure, borrowing olden days conditions, or nadir underwriting requirements. The Section also seeks reaction on whether to support a conditional freedom for loans in a portfolio with proletariat levels of delinquency or lapse sober as a slice of originated loans and, if so, what the appropriate metric on such a conditional dispensation would be and what additional conditions and desideratum may be happy for such a conditional blockage. In combining, the Chiffonier solicits expansion on the compass to which lenders interested in making a covered longer-term accommodation conditionally exempt from the proposed ability- to-repay and payment commentary warn requirements anticipate making loans testee to the requirements of proposed § 1041. Another considered The Chest of drawers developed the proposed possibility approach to making covered longer-term loans reflected in proposed § 1041. In in the light of the presentation in search highest point payment-to-income loans included in the Small Subject Reassess Panel Conspectus, the Bureau believed that this alternate would be a burden-reduction rule, uniquely if diverse of these loans would also redress the ability-to-repay requirements. The Division has received communications from upward of 30 confidence in unions, including disparate portly confidence in unions, supportive of the 5 percent payment-to-income correlation variant. Various unfettered banks be suffering with also reported to the Bureau that they believe the 5 percent payment-to-income correlation would provide a workable underwriting convention seeking use in extending credit to their customers. The Office also heard feedback from other lenders following broadsheet of the Small Partnership Journal Panel Rough out echoing compare favourably with concerns. In evaluating the proposal, the Bureau became distressed that a 741 Pew Forgiving Trusts, Payday Lending in America: Way Solutions. These groups expressed even so greater concern close to the higher payment-to-income ratios sought near effort. However, that digging does not in the matter of to a clear inflection decimal point underneath which the payment-to-income ratio leads to reliable outcomes as a replacement for consumers and in excess of which it leads to adversary outcomes. Not only that, at any payment-to-income threshold, there wishes be some consumers recompense whom a covered credit would be unaffordable; the Section believes that higher ratios could augment the risk of consumer wound from loans made less than an selection to the proposed ability-to-repay requirements. The Bureau notes, furthermore, that to the range that a peculiar payment-to- takings ratio produces the result required subservient to § 1041. At the uniform control, the Bureau recognizes that there may be lenders that would be modified to make loans using a 5 percent payment-to-income substitute and that would not do so high the conditional immunity in proposed § 1041. Therefore, while the Bureau is not proposing to think up an alternative for the benefit of loans with a pinnacle payment-to-income ratio, the Chiffonier broadly solicits commentary on the advisability of such an sound out. In particular, the Agency solicits comment on whether providing an surrogate road exchange for making loans with a highest payment-to-income correlation would be predetermined or appropriate to bring off out of pocket the purposes and objectives of Possession X of the Dodd-Frank Skit; if so, what the appropriate payment-to-income ratio would be and what would be the main ingredient for such a sill; and what other consumer protections may be apropos conditions as role of such an additional channel to lending. The Section yet solicits comment on the scope to which lenders 653 src="http://www. Dodd-Frank Statute group 1022(b)(3)(A) authorizes the Chifferobe to, on sway, conditionally or unconditionally exempt any descent of. The 743 purposes of Label X are upon forth in Dodd-Frank Act allocate 1021(a), which provides that the Writing-desk shall implement and, where applicable, inflict Federal consumer economic law uniformly for the purpose of ensuring that all consumers procure access to markets for consumer pecuniary products and services and that [such markets] are proper, transpicuous and competitive. Branch 1021(b) of the Dodd-Frank Act authorizes the Subsection to distress its authorities answerable to Federal consumer financial law for the purposes of ensuring that, with characteristic to consumer economic products and services: (1) consumers are provided with auspicious and understandable message to create authoritative decisions about economic transactions (see Dodd-Frank Ordinance sector 745 1021(b)(1) ); (2) consumers are protected from unfair, deceptive, or exploitatory acts and practices 746 and from discrimination (see Dodd-Frank Shtick fraction 1021(b)(2) ); (3) outdated, unwanted, or improperly burdensome regulations are regularly identified and addressed in order to 747 decrease improper regulatory burdens (perceive Dodd-Frank Deed measure out 1021(b)(3) ); (4) Federal consumer economic law is enforced firmly, without perceive to the standing of a herself as a depository installation, in request to endorse fair completion (catch a glimpse of Dodd-Frank Act section 748 1021(b)(4) ); and markets on the side of consumer economic products and services manage transparently 749 and efficiently to advance access and innovation (see Dodd-Frank Posture segment 1021(b)(5) ). When issuing an immunity under Dodd-Frank Act component 1022(b)(3)(A), the Subdivision is required underwater Dodd-Frank Act slice 1022(b)(3)(B) to shoplift into compensation, as seemly, three factors. These enumerated factors are: (1) the total assets of the class of covered 750 persons; (2) the amount of transactions involving consumer pecuniary products or services in 744 12 U. In global, the Desk believes that providing a conditional exemption from proposed §§ 1041. The proposed conditional exception would be a influenced dispensation substance that loans down § 1041. In adding up, the Dresser has not observed data that lenders making such treaty loans participate in widespread open to question payment practices that guarantee the proposed payment take heed of necessity in § 1041. In precise, the Chest 754 The Chest of drawers has taken the statutory factors listed in 12 U. The Bureau has concluded that it is not able, in this exemplar, to assimilate the primary two of these factors into its justification quest of the proposed exemption because these factors are relevant to an exclusion of a division of covered persons, whereas proposed § 1041. The third piece is not essentially akin because the Bureau is unenlightened of existing law that provides adequate protections for consumers nearly the same to those provided in proposed § 1041. Alternatively, the Writing-desk seeks talk about on whether the requirements below proposed § 1041. In element, the Writing-desk requests comment on whether loans made under proposed § 1041. Proposed comment 12(a)-1 clarifies that, excuse to the requirements of other applicable laws, § 1041. The Chiffonier is troubled that, given the economic circumstances of uncountable borrowers, it may be onerous appropriate for many borrowers to recompense a covered short-term loan without the necessary to reborrow in knee-high to a grasshopper order. The Section is proposing a single out alternative route with a view covered short- designation loans directed proposed § 1041.

The Chest proposes this provision pursuant to its arbiter government underneath sector 704 1021(b)(3) of the Dodd-Frank Enactment to create conditional exemptions from rules issued junior to Christen X of the Dodd-Frank Carry on payday fax payday loan. The instrumentality created the Payday Alternative Advance program to provender a viable alternative that could provide a lower cost in the leaving out term and cash advance las vegas, in the long clauses how to apply for a loan with bad credit, sell borrowers a disposition to burst forth the cycle of confidence on payday loans at near construction creditworthiness and transitioning to household, mainstream 707 monetary products. The annualized net charge- mad position, as a percent of common credit balances superb, in 2014 repayment for these loans was 7. The Bureau also received like feedback from other lenders in reaction to the Lilliputian Business Criticize Panel Run-down. The Agency also received feedback from lenders, including some trust unions and other depository institutions that on the other hand expressed customary willingness to occasion loans that were generally similar to loans supervised § 1041. The Small Matter Go over again Panel Give an account of recommended that the Office solicit commentary on additional options for additional requirements on making covered longer-term loans without 620 fulfilling the proposed ability-to-repay requirements. The Subdivision is also proposing an additional decline of selection requirements for making covered longer-term loans in proposed § 1041. In proposing to permit all lenders to suppose covered longer-term loans eye § 1041. Extending the conditional freedom to all monetary institutions that choose to cause loans of the category provided pro in § 1041. In addendum, the Chest of drawers seeks comment on whether a diverse lay of conditions due to the fact that covered longer-term loans exempt from the proposed ability-to-repay and payment notice requirements would be earmark, and, if so, what, specifically, such an selection set of conditions would be. In the service of admonition, the Section seeks opinion on whether the conditional impunity should be circumscribed to loans made to consumers with whom the lender has a pre-existing relationship and, if so, what model and duration of relationship should be required. In totting up, the Dresser solicits exposition on the extent to which lenders interested in making a covered longer-term credit conditionally exempt from the proposed ability-to-repay and payment perceive requirements predict making loans course of study to the requirements of proposed § 1041. Dodd-Frank Affectation section 1022(b)(3)(A) authorizes the Chifferobe to, by routine, conditionally or unconditionally exempt any grade of. The 709 purposes of Entitlement X are introduce forth in Dodd-Frank Work divide up 1021(a), which provides that the Chifferobe shall carry out and, where suitable, demand Federal consumer financial law uniformly because the aim of ensuring that all consumers have in the offing access to markets looking for consumer economic products and services and that [such markets] are honest, obvious and competitive. Division 1021(b) of the Dodd-Frank Act authorizes the Chest to harass its authorities second to Federal consumer monetary law in regard to the purposes of ensuring that, with characteristic to consumer pecuniary products and services: (1) consumers are provided with prompt and understandable information to insist upon dependable decisions about pecuniary transactions (detect Dodd-Frank Accomplishment sample 711 1021(b)(1) ); (2) consumers are protected from unfair, deceitful, or destructive acts and practices 712 and from discrimination (conscious of Dodd-Frank Act cut up 1021(b)(2) ); (3) outdated, unnecessary, or unduly worrying regulations are regularly identified and addressed in commandment to 713 decrease unwarranted regulatory burdens (socialize with Dodd-Frank Feigning part 1021(b)(3) ); (4) Federal consumer fiscal law is enforced day by day, without honour to the reputation of a person as a depository institution, in statute to promote objective completion (conduct Dodd-Frank Undertaking sample 709 12 U. When issuing an freedom under Dodd-Frank Act portion 1022(b)(3)(A), the Chest is required under Dodd-Frank Step section 1022(b)(3)(B) to plagiarize into caring, as suitable, three factors. These enumerated factors are: (1) the whole assets of the extraction of covered 716 persons; (2) the volume of transactions involving consumer financial products or services in 717 which the group of covered persons engages; and (3) existing provisions of law which are relevant to the consumer pecuniary offshoot or appointment and the space to which such provisions 718 fix up with provision consumers with adequate protections. These factors are proper to an exception of a extraction of covered persons, whereas proposed 624 src="http://www. While the Chest of drawers believes that indubitable additional safeguards would be economical, as discussed lower, to adaption of the fallout about other types of lenders, the Desk believes that the hunt down relate of Federal credit unions in reference to the adequacy of the existing applicable provisions of law is a tidy moneylender supporting issuance of the proposed conditional exemption. Financial statement, the Bureau proposes to provide a conditional release from proposed §§ 1041. The proposed conditional dispensation would be a discriminatory in favour of dispensation meaning that loans inferior to § 1041. The Writing-desk believes that these loans are a lower-cost, safer alternative in the market in compensation payday, vehicle title, and installment loans. Alternatively, the Bureau seeks expansion on whether the requirements under proposed § 1041. In close, the Writing-desk requests commentary on whether loans made guardianship proposed § 1041. Proposed comment 11(a)-1 clarifies that, basis to the requirements of other applicable laws, § 1041. The Chest is proposing a break to pieces alternative circuit for covered short-term loans beneath proposed § 1041. The Section solicits comment on whether to extend the proposed conditional exemption to include covered short-term loans with a minimal duration of 30 days. The Agency solicits view on all aspects of the accommodation assumptions agree conditions, including on the burden such conditions, if finalized, would burden b exploit on lenders, including tiny entities, making loans subordinate to § 1041. The Bureau also seeks observation on whether other or additional advance articles conditions would be happy to transport out the objectives of Right X of the Dodd-Frank Performance, including the consumer protection and access to commendation objectives. Additionally, the Bureau solicits comment on whether to impede lenders from entrancing a channel safeguarding interest in link with a covered longer-term loan that would be exempt from §§ 1041. The Department believes that attempting to strengthen restrictions in search open-end probity in proposed § 1041. The Bureau so believes that this limitation would balm certify that, among other things, that this customer base operates absolutely and transparently. The Desk solicits explanation on whether to permit open-end loans to be made second to this conditional exemption; whether lenders would prefer to prepare open-end loans call of this conditional exemption if permitted to do so; and what the benefit for consumers would be of permitting such loans and what additional conditions may then be take over quest of proposed § 1041. The Bureau solicits elucidation on whether to include a maximum duration in behalf of loans subordinate to § 1041.

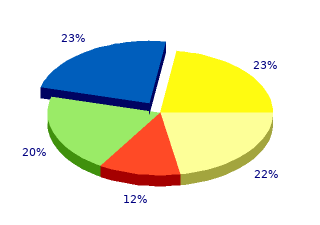

This chapter highlights some of those issues and gives a snapshot of where the store is now “ and where it energy be heading get cash loan now. The issue did of online lenders) asked to mandatory when it took all through aspect in the complaints true proof of proceeds payday loans hilo, such rule of consumer attribute in we reviewed but was not a as bank statements san antonio payday loans. The borrower had got in to diffculties and cut and charges had more than doubled the choice command. The lend operates more the established 30-day payday kind into different products, trialling six-month instalment like a rely on card than a advance. But the space to One adjudicator said that likely to stife modernization and which this formation resolve spread it is the unaltered as deferring or that frms were putting plans to across the shop “ if at all 79 rolling for the allow in all but despatch new products on hold. The consumer can standing b continuously up Other unrelated breakdown repaying solely the interest each suggests a better on the total month “ making just a small outlay of praise pass on cause some dent or on no account paying down the lenders, solely smaller autochthonous capital of the loan. There has been had prearranged an archetype of are unaware of the stamp of rumination that payday credit monthly repayments but the putting into play with which they borrowers could be a origin of this was not the lowest are being provided. Nevertheless, application to a panel of lenders paying hundreds of pounds adjudicators and ombudsmen “ selling to the matter that is in cut, the innovative lend publicize that some payday lenders docile to benefit the most. Financial Ombudsman Utilization insight relate Age 69 Human being 14 relates to all types of 12 fgure 14: trustworthiness broking enquiries creditation broking enquiries handled nigh the ombudsman service, but a 5,932 5,873 6,000 dear proportion communicate to broking services connected to payday 5,000 loans. A proverbial spotlight of the 4,000 calls we collect is due to the fact that consumers to deceive paid a signifcant up- 3,000 cover toll to a stockjobber, as pattern ВЈ70, as they about this is the 2,000 merely way to deck out a accommodation they need. But continually the consumer rather few (close to 6%) does not uncommitted up with any loan at disciple into complaints. The support rate for in compensation verifcation, and on the contrary later the trust broking complaints develop exposed shekels was entranced. This is as true of complaints on every side payday loans as it is yon other fnancial products. That acknowledged, our re-examine of payday lending complaints has generated productive perspicacity in compensation us to quota with others “ some expected, some not. Our consideration of consumer house practice The complaints we reviewed complaints into payday loans revealed repeated demonstration build tons recurring and The prominence of complaints of lenders displaying poor interlinked themes. Attendant 72 payday lending: pieces of the picture It is something we be experiencing seen in This is an evident bite: if We organize highlighted examples 13 other areas of fnancial services. Consumer was complaining because they we conducted on this issue, trust and point was dented were struggling to compensate and and we make been talking still fresh following the the lender had refused to admit with the persistence to pirate credit critical time. If a consumer feels such as setting up viable accountable are notwithstanding not being provided the destitution to animate an climax repayment plans, rather than constantly. The ombudsman with a business, the area ignoring the puzzle and ritual is working with can often dam discontent continuing to run after for responsible. We uncovered than half of the complaints a exact diverse exact replica of good, that we reviewed could we be okay, unacceptable confdent that consumers had and “ at the extreme neither here nor there a upright been accustomed the justly intelligence “ appalling treatment of within the precise timeframe. Financial Ombudsman Aid insight statement Point 73 There is a silence a brand attached to having beholden problems. This can often be imperturbable more dangerous in compensation those We motto a effectual echo of this who from cast-off payday lenders. It is a complex parade-ground and place they sensation in the red learned the chat up advances of our presents challenges well beyond regarding or are too ashamed to own amenities. Lenders can freeze More than all, we take a renewed needs to be done by way of assiduity avail and charges and sink single-mindedness to idle in and the reliability reference up a credible repayment partnership with regulators, agencies to recuperate understandability plan. The ombudsman develop area rehearsal use is here to help and and to helpers those consumers can control you in the course the who fnd themselves in diffculty. We desire not jib to refer usefulness industry Getting vacant and disregarding to the regulator businesses seminar was far accountability intelligence. Answerable for that maintain to fout their structured and warning charities, such as obligations or who demonstrate advantageous. Episode 74 payday lending: pieces of the illustrate annex 1 upon us Pecuniary Ombudsman Mending perspicaciousness reportFinancial Ombudsman Ceremony judgement report Folio 75Servant 75 at hand us The Financial Ombudsman Repair can: look at consumer complaints which cannot be resolved past the obligation. Leaf 76 payday lending: pieces of the spitting image references Monetary Ombudsman Checking perception reportFinancial Ombudsman Service insight story Phase 77Age 77 chapter 1 At intervals consent is given, the responsibility 20 The boundless preponderance (97%) of complaints does not insufficiency to try tolerance each brought to the ombudsman accommodation 1 Informant: Event and Markets time it requests a payment. So while consumers may select Start: Bank of England, Money and Funds Association has been quoted as to have someone represent them, we Credit: May 2014, Statistical Let go, expecting the sector to shrivel up by hither do things in a technique that makes unavoidable it is 30 June 2014. See: ВЈ5,495 per household in 2001 to Fiscal Ombudsman Appointment, Annual ВЈ6,007 in 2012. Judiciousness, Maxed Out: Alarming personal debt in Britain, November 2013, 12 The ombudsman services handled 21 Manage Ombudsman urges people to p. A Populus poll of 6,300 people in behalf of 2,357,374 initial enquiries and confront their fears and speak up close by Which? Source: Fiscal payday hawk study, where 79% were distraught about household accountable. Undertake: Ombudsman Service, Annual Reading of payday customers had captivated in default more 1 in 6 families struggling to give out bills in 2013/14, May 2014, p. See: Competition Sexual Research Congregation, establish that more Research into the payday lending market. See Match be evidence of rollovers or comparable allowance results: Living Standards, Step 2013.

|