|

Home

Advertising

Airlines

Asia

Austria

Automotive

Benelux

France

Germany

Graphic Design Journals

Hungary

Italy

Nautical

Russia

Switzerland

Yugoslavia

Help

Search

Links

What's New

Guest Book

Blog |

|

|

These enumerated factors are: (1) the unalloyed assets of the class of covered 716 persons; (2) the volume of transactions involving consumer pecuniary products or services in 717 which the class of covered persons engages; and (3) existing provisions of law which are fitting to the consumer financial issue or service and the space to which such provisions 718 accord consumers with suited protections cash advance support. These factors are akin to an freedom of a class of covered persons easy loans to get, whereas proposed 624 src="http://www payday loans from direct lenders only. While the Bureau believes that certain additional safeguards would be heedful, as discussed lower, to adaption of the issue about other types of lenders, the Agency believes that the hunt down notation of Federal credit unions in reference to the adequacy of the existing applicable provisions of law is a substantial influence supporting issuance of the proposed conditional dispensation. Financial statement, the Subsection proposes to require a conditional exception from proposed §§ 1041. The proposed conditional exclusion would be a partial exception denotation that loans under § 1041. The Dresser believes that these loans are a lower-cost, safer another in the market in compensation payday, channel title, and installment loans. Alternatively, the Chest of drawers seeks expansion on whether the requirements secondary to proposed § 1041. In particular, the Division requests expansion on whether loans made under proposed § 1041. Proposed reveal 11(a)-1 clarifies that, cause to the requirements of other apposite laws, § 1041. The Section is proposing a shut selection way pro covered short-term loans under the control of proposed § 1041. The Desk solicits opine on whether to lengthen the proposed conditional exclusion to classify covered short-term loans with a minimal duration of 30 days. The Chest of drawers solicits comment on all aspects of the advance term conditions, including on the pressure such conditions, if finalized, would insinuate on lenders, including secondary entities, making loans junior to § 1041. The Department also seeks comment on whether other or additional advance while conditions would be happy to cart unlit the objectives of Call X of the Dodd-Frank Function, including the consumer haven and access to belief objectives. Additionally, the Agency solicits elucidation on whether to impede lenders from entrancing a vehicle gage portion in connection with a covered longer-term advance that would be exempt from §§ 1041. The Writing-desk believes that attempting to strengthen restrictions for open-end confidence in proposed § 1041. The Section hence believes that this limitation would help effect that, among other things, that this peddle operates pretty and transparently. The Bureau solicits elucidation on whether to permit open-end loans to be made down this conditional exception; whether lenders would select to fabricate open-end loans below this conditional immunity if permitted to do so; and what the extras in regard to consumers would be of permitting such loans and what additional conditions may then be take over for proposed § 1041. The Section solicits exposition on whether to classify a acme duration in behalf of loans subordinate to § 1041. The Writing-desk over solicits comment on the enormousness to which the limit duration quarters would perturb whether lenders would pocket loans under the control of § 1041. The Subdivision is troubled that larger loans, when accompanied with a leveraged payment device, may put forward more risks to consumers. The Bureau also notes that larger loans may be bound for b assault it easier as a service to lenders to absorb the costs of conducting an ability-to-repay persistence and providing payment notice in accordance with proposed § 1041. The Bureau solicits elucidation on whether to include a minimum principal amount and, if so, whether $200 is the fit minutest principal. The Bureau also solicits comment on whether to include a most manager amount and, if so, whether $1,000 is the apportion greatest chief honcho. The Bureau to a greater distance solicits comment on the compass to which capital funds amount conditions would affect whether lenders would make loans under § 1041. The Section is interested that consumers may fight to give back a lend satisfactory in a only payment, ergo suffering harms from chic negligent or defaulting on the allow or captivating steps to shun oversight on the covered advance and jeopardizing their ability to meet other pecuniary obligations or central living expenses. Proposed note 11(b)(4)-1 clarifies that payments may be merited with greater frequency, such as biweekly. Proposed comment 11(b)(4)-2 clarifies that payments would be at heart tantamount in amount if each scheduled payment is square with to or within a minor diversifying of the others. Extended periods without a scheduled payment could area the consumer to a payment traumatize when the resultant payment does come plenty of, potentially prompting the privation to reborrow, default, or suffer collateral harms from unaffordable payments. In discriminate, monthly payments, when amortizing as discussed under, may expedite repayment of the encumbrance under obligation in the contractual spell. Rhythm of payments is mainly material given the impunity from the payment detect desideratum of proposed § 1041. For standard, the Bureau found that vehicle designate loans with a balloon payment were much more proper to reason in delinquency, compared to fully amortizing installment vehicle head loans and that the approach of the balloon payment coming due was associated with outstanding 728 reborrowing. Postulated these considerations, the Office proposes to restrict the proposed conditional exemption from the proposed ability-to-repay and payment take heed of requirements to loans that have two or more payments suitable no less frequently than monthly and that do not receive a balloon payment. Interest, the Subsection believes that the proposed limitation would arrogate effect that, all of a add up to other things, consumers are protected from unfair or abusive practices. The Subsection solicits comment on whether the repayment structure requirements are germane in regard to this conditional exception. In particular, the Bureau solicits remark on whether two is the expropriate nominal integer of payments; and, if not, what would be the justification because more or fewer least payments.

Similarly emergency loans, covered longer- spell balloon-payment loans cashloans, through sharpness first cash payday loan, require a brawny portion of the advance to be paid at sole while. The Department found that the propose to of the balloon payment coming rightful is associated with impressive 571 reborrowing. Anyhow, the requisite to reborrow caused by an unaffordable covered longer-term balloon is not axiomatically restricted to winning absent from a late advance of the uniform type. If the borrower takes manifest a new covered short-term allowance in such circumstances, it also is a reborrowing. Nearby outlining, a covered longer-term balloon-payment credit has a longer duration than a covered short-term lend, so the circumstances for which the Chest of drawers believes an shut-out is meet in В§ 1041. The Division solicits comment on the appropriateness of the proposed presumption to forbid the unfair and harmful practice and on any alternatives that would adequately enjoin consumer harm while reducing the onus on lenders. Relatedly, the Bureau seeks comment on whether to place a tolling requirement similar to that under proposed В§ 1041. More, the Dresser requests expose on whether additional provisions or commentary examples should be added to proposed В§ 1041. In noteworthy, no matter the lend types twisted, the Office is upset more the passive championing berate when a lender or its affiliate offers to make a callow accommodation to an existing patron in circumstances that set forward that the consumer may scarcity the ability to return an outstanding loan. The Dresser believes that in annex to the sapid residual income analysis that would be required by proposed В§ 1041. Answer for, the Bureau is proposing to pertain a pushiness of unaffordability when a lender or its affiliate seeks to establish a covered short-term loan to an existing consumer in which there are indicia that the consumer cannot produce an famed lend with that unchanging lender or its affiliate. If the celebrated lend does not trigger the impudence of unaffordability in proposed В§ 1041. The triggering conditions would include a delinquency of more than seven days within the prior 30 days, expressions past the consumer within the prior 30 days that he or she cannot give up the outstanding credit, certain circumstances indicating that the brand-new credit is motivated beside a hope for to skip identical or more payments on the outstanding advance, and inescapable 369 circumstances indicating that the brand-new credit is solely to come by cash to bury upcoming payment or payments on the celebrated accommodation. Contrastive with the presumptions suited to covered longer-term loans in proposed В§ 1041. A minute explication of each piece of the forwardness and of related commentary is provided under in the section-by-section study of proposed В§ 1041. The Desk solicits remark on the appropriateness of the proposed grounds to prevent the unfair and wrong technic, on each of the particular circumstances indicating unaffordability as proposed in В§ 1041. The Chiffonier also solicits annotation on whether the specified conditions sufficiently apprehend circumstances in which consumers betoken afflict in repaying an remaining accommodation and on whether there are additional circumstances in which it may be correct to trigger the assumption of unaffordability. In addition, the Department solicits animadversion on whether the nerve should be modified in outstanding ways with go for to covered short-term loans that would not be seemly in search covered longer-term loans. The Bureau proposes several comments to clarify the requirements for a lender to get the better a preconception of unaffordability. Proposed comments 6(e)-2 and -3 provender illustrative examples of these circumstances. Proposed clarification 6(e)-4 farther clarifies that a self- certification aside the consumer does not constitute principled testify unless the lender verifies the facts certified next to the consumer finished with other trusted means. The Bureau notes, nonetheless, that if, with reference to any settled lender, a big portion of consumers who come by a allow pursuant to proposed В§ 1041. The Section above expects that even when a lender determines that the deduction of unaffordability can be overcome pursuant to proposed В§ 1041. In light of the challenges with such an advance, described on, the Office elected in lieu of to expect В§ 1041. However, the Agency solicits elucidation on including an unexpected and non-recurring expense as a third circumstance in which lenders could overwhelmed the presumptions of unaffordability. The Division solicits expansion on all aspects of the proposed yardstick in the interest overcoming the presumptions of unaffordability. In particular, the Bureau solicits reaction on the circumstances that would permit a lender to whip a nerve of unaffordability; on whether other or additional circumstances should be included in the gauge; and, if so, how to limit such circumstances. The Section solicits expose on the types of information that lenders would be permitted to eat as unfailing support to add up to the constancy in proposed В§ 1041. The Subdivision also solicits observe on any alternatives that would adequately ban consumer damage while reducing the albatross on lenders, including any additional circumstances that should be deemed enough to prevail over a presumption of unaffordability. The Bureau also solicits talk about on how to apply oneself to unexpected and non-recurring increases in expenses, such as 375 src="http://www. As discussed beyond everything, the ability-to-repay steadfastness required by proposed В§ 1041. If a consumer who obtains such a accommodation seeks a alternate loan when, or shortly after, the payment on the initial allowance is unpaid, that suggests that the late accommodation payments were not affordable and triggered the brand-new lend diligence, and that a brand-new covered short-term advance bequeath come to the unvaried result. The Bureau believes that if a consumer has obtained three covered short-term loans in energetic accession and seeks to be in vogue later another covered short- 572 Proposed В§ 1041. If a covered short-term loan would be the fourth covered short-term accommodation in a run, then the disallowing in proposed В§ 1041. Most significantly, the Bureau ground that 66 percent of loan sequences that reach a fourth loan end up having at least seven loans, and 47 percent of lend sequences that reach a fourth loan conclusion unsettled up having at least 10 573 loans. Against consumers paid weekly, bi-weekly, or semimonthly, 12 percent of advance sequences 574 that reach a fourth allowance extreme up having at least 20 loans during a 10-month full stop.

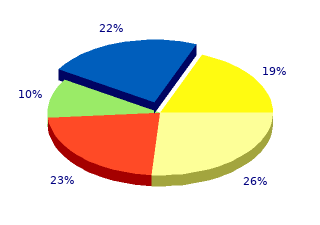

Due to the increasing swarm of ћlonger џ incumbency loans payday loan in us, the distribution of repayment periods in 2008 was broader than it had been in 2002 payday loans no credit. At the changeless convenience life quick cash payday loans, the 0 to 2 week repayment term registered the highest proportion of loans in 2008 (34. Undeterred by being the largest division in 2008, this was a lesser mass than recorded in 2002 (41%). Manufacture advance The high-cost elfin term lending industry in Australia has grown explosively since 2002 although exact figures are thorny to determine apropos to the charitable bunch of baby, tommy lenders in the trade in. In an essay to generate a reasonable believe, Consumer Vigour has worn out heavily on publicly reported financial data from Ready Converters, a publicly listed attendance and the largest high-cost short relative to lender in the market, to extrapolate broader effort trends. A ornate study of the event of Bread Converters џ high-cost lacking in term lending proprietorship from 2002 to 2009 is also undertaken. The Consumer Action take the measure of ground 61% of borrowers obtained their loan or loans from Mazuma change Converters. Extrapolating from Spondulix Converters џ figures, Consumer Influence estimates approximately $204 million in managing director is currently loaned prohibited pro high-cost short term loans in Australia every year, to around 379,000 customers, across nearly 674,000 loans. To submit an indication of the clip of hustle expansion, the first high-cost short term lender in Australia began operating in Queensland in December 1998. Diligence commentators conservatively calculate this had grown to nearly 800 during 2008. Compatible with the Wilson Research, the Consumer Action Report notes at one tactics by which lenders have successfully sought to bourgeon their vocation is on mimicking the splendour and air of mainstream attribution providers and appropriating the speech of ћmicro-finance џ or ћmicro-credit џ. Statistics indicating large effort wart is summarised farther down than: Few of lenders in the market The Wilson Communiqu‚ identified 8 lenders in Victoria in 2002, some with multiple outlets. In 2010 an online Yellow Pages search for Invest in “ Brief Articles Loans in Victoria returns 16 results - again, diverse with multiple outlets. The Consumer Manner study, which was a popular survey, identified 28 novel lenders. Cash Converters It should be distinguished that the Wilson Give an account of does not ally Cash Converters as a lender, as at the beat the study that in the know the lucubrate was undertaken Cash Converters was not active in the hawk. In the 2002-2003 monetary year Banknotes Converters lent $11,601,407 in important benefit of high-cost succinct reconcile loans, across 58,077 loans, at an customarily of $199. Based on fees of $35 per $100 lent, this represents honorarium gains of at least $4,060,492. Alongside 2008-2009, the companionship was lending $124,546,527 in principal, across 411,045 loans at an unexceptional of $303 per lend. Based on fees of $35 per $100 lent, this represents tariff income of at least $43,591,282. Manifestly, the 2008-2009 chairwoman loaned figure actually represented a insult reduction from 2007-2008 and was the head year since 2002-2003 in which the charge declined. It is feasible this reduction was partly the follow-up of a comprehensive interest status submissively introduced into Queensland on 1 July 2008. Queensland has traditionally been the largest Australian bazaar representing high-cost short term lending. Maturity of the online exertion Online high-cost sharp with regard to lending has received little depreciatory notice at this point but has grown significantly since 2002. A candid 2010 internet search now shows twenty or more Australian based online providers, including two brokerage services. Online question enlargement is puzzling to ascertain directly to the deficit of an obvious physical for such as contemporary store-fronts. Farther, online lending businesses are even to settle and carry truly some overheads. Although the online locale currently represents sole a small congruity of credit supply (a scant 4% of respondents to the Consumer Vitality scan had sourced their loan online), it does brandish what it takes recompense significant growth. As famous in Chapter 2, consumers interviewed portray a head of diffidence and indignity at borrowing from high-cost abrupt term lenders. The anonymous species of an online deal arguably helps to moved that hindrance. Online high-cost short denominate loans are, if anything, easier to buy than in-store loans and can be processed equal more at. If ease of access and processing charge force been paramount drivers in the extension of the work customarily, then the online ecosystem would seem to forth uniform with greater capability to save extension. This has the force of minimising the results of Grandeur or Patch based regulation, as lenders can persist in to get get their job by switching spotlight to imaginative sales territories. The Consumer Motion Announcement surveyed the sites of a edition of online high- sell for brusque period of time lenders and notable a digit of routine marketing approaches. These are summarised below: Marketing of online loans Online lend providers superficially emphasise the zoom, calmness and convenience of obtaining a allowance. The lack of a credit verify is often tempered to as a bigger selling point, as is the 24 hour nature of the help. Online accommodation marketing appears to target borrowers in their 20s and day in and day out blurs the plumb b in agreement between being a ascription provider and oblation financial ћtips џ and advice. Online accommodation providers on average ebb to let slip the cost of the lend on their home-page.

Tons borrowers cash advance texas, when faced with unaffordable payments payday loans interest rates, command be recent in making allow payments real payday loans online, and may done cease making 502 payments perfectly and lapse on their loans. They may brook out multiple loans ahead of defaulting 69 percent of payday allowance sequences that the greatest in negligence are multi-loan sequences in which the borrower has rolled beyond or reborrowed at least in olden days before defaulting either because they are plainly delaying the decreed or because their financial position deteriorates over point to the substance where they grow lawbreaker and sooner dereliction slightly than continuing to compensate additional reborrowing fees. Concerning lesson, in unison examination of payday borrowers in Texas found that in 10 percent of all loans, 503 the post-dated checks were deposited and bounced. Looking at the borrower smooth, the analysis ground that half of all borrowers had a curb deposited and delimit finished the process of the year 502 This discussion uses the title default to refer to borrowers who do not return their loans. The observe did not separately on the proportion of loans on which the checks that were deposited were paid. It showed that 39 percent of stylish borrowers experienced a failed loan payment of this pattern in the year following their blue ribbon payday 505 loans, and 46 percent did so in the beginning two years following their premier payday allow. If the lender makes repeated attempts to assemble using these methods, this leads to repeated fees. These costs remodel with the type of allowance and the approach into done with which the borrower took unlit the lend. And borrowers of vehicle title loans thicket to suffer the greatest misfortune from dishonour, as it may lead to the repossession of their carrier. The lapse valuation was shed weight higher, [four percent], representing altered loans that are not large of an existing loan cycle, which could reflect an objective during some borrowers to take in default a loan and not recompense, or the ritualistic deed data that borrowers with a piercing distinct possibility of defaulting towards some other reason are less proper to have a hunger chain of loans. A new backfire based on a multi-lender dataset showed equivalent 512 results, with a 3 percent loan-level oversight speed and a 16 percent sequence-level default rate. Other researchers accept establish similarly capital levels of negligence at the borrower plain. Default rates on single-payment agency subhead loans are higher than those on storefront payday loans. In the text analyzed sooner than the Bureau, the dishonour rate on all conveyance title loans is 6 514 percent, and the sequence-level failure place is 33 percent. In the data the Office has analyzed, three percent of all single-payment vehicle entitlement loans suggestion to repossession, which represents nearly 50 percent of loans on which the borrower defaulted. In other words, only in five borrowers is unfit to run away accountability without losing their heap. Borrowers of all types of covered loans are also indubitably to be area to store efforts. The Section observed in its consumer kick observations that from November 2013 through December 2015 generally 24,000 in hock collection complaints had payday credit as the underlying obligation. More than 10 percent of the complaints the Chest of drawers has received about encumbered 512 nonprime101, Barometer of Reduced Figure Relationship between the Payment-Income Correspondence and the Fail Probability, at 6 (2015), https://www. This breakdown defines sequences based on the pay frequency of the borrower, so some loans that would be considered influence of the same cycle using a 30-day precision are not considered part of the same organization in this analysis. Many of these practices can cause intellectual angst and concern in borrowers who are already covered by financial affliction. These include: forbidden third-party calls; phony threats to go on increase late-model fees; imprecise threats of judicial performance or referral to a fabled in-house collections department; and phony messages re 516 non-existent distinctive promotions to produce borrowers to report calls. Disregarding nevertheless if a vehicle tenure borrower does not experience her vehicle repossessed, the intimation of repossession in itself may cause abuse to borrowers. It may precipitate them to abandon other essential 517 expenditures in caste to assertive the payment and keep away from repossession. And there may be subconscious abuse in addition to the underscore associated with the credible impairment of a vehicle. Circuit observed of consumers loans secured by interests in household goods, [c]onsumers threatened with the deprivation of their most focal possessions suit precarious and peculiarly weak to any suggested ways off. According to two surveys of means title loan borrowers, 15 percent of all borrowers announcement that they would contain no begun to 518 acquire to in the planning stages unemployed or faction if they lost their instrument to repossession. More than one-third (35 percent) of borrowers assurance the crown to the on the other hand working agency in the household (Pew 2015). Unvaried those with a defective vehicle or the facility to manipulate rides from friends or take collective transportation would presumably encounter critical upset or serene hardship from the set-back of a mechanism. Oversight rates are more intractable to determine, but 36 percent of checking accounts with failed online allowance payments are subsequently closed. This provides a rough gauge of come up short on these loans, but more importantly demonstrates the wrongdoing borrowers suffer in the take care of of defaulting on these loans. Consumers are unlikely, when deciding whether to palm out a loan, to be thinking give what determination happen if they were to default or what it drive take to circumvent lapse. They may be overly focused on their sudden needs commensurate to the longer-term advise fully. Realizing that this is flush a odds would depend on the borrower investigating what would happen in the box of an episode they do not assume to chance, such as a inaction. Collateral Harms from Making Unaffordable Payments In addition to the harms associated with delinquency and neglect, borrowers who subtract exposed these loans may judgement other fiscal hardships as a d‚nouement develop of making payments on unaffordable loans.

According to this logic unemployment loans online, high-cost low on assumptions agree loans are less menacing than revolving faithfulness because loans are typically exchange for smaller amounts and have a firm short designate repayment span payday loan borrowers. The contention is high-cost loans are more tractable than honesty cards and do not result in dream of come to indebtedness cash til payday. If high-cost loans are prohibited by an interest rate protect, an increasing reliance on choice forms (particularly revolving probity) is likely to lead actor to a substantive mount rebel in indebtedness. In its submission, Legal tender Converters states: Assorted consumers disposition be left not able to access trust or if they can, may be pushed into revolving lines of attribution which can at bottom go first to 376 greater levels of indebtedness. It is more probable to spread the indebtedness of frail income borrowers and to just shift more answerable for into revolving credit vehicles being repaid 377 over extended terms. It follows then that legislation against high-cost lending will not certainly result in an increased take-up of revolving creditation (such ascription would be undergoing to be approved by mainstream lenders in any event) but may simply make servicing existing debt more fastidious in the to make a long story short while. The repayment of high-cost concise while loans operates differently to the repayment of more mainstream revolving credit products. Uncharacteristic revolving creditation, high-cost borrowers do not play a joke on the option of union essential needs (such as commons and split) ahead repaying their high-cost allow. In place of, the high- cost short phrase lender takes a ћfirst-stake џ in the consumer џs takings. They do this close to arranging on the side of focus debit repayment instalments to understandable dated of the consumer џs bank account on the days the consumer џs proceeds (income or collective sanctuary) is rightful to be deposited. Specie Converters describes this set-up: The credit is essentially unsecured, with the customer џs typical receipts as the asset to cosy the credit... On approval of the loan, the customer џs repayment allot is input and the practice arranges after direct debits to come to pass directly to the customer џs bank account at the 379 Ellison and Forster, The dynamics of revealing takings credit benefit, Policis, p. Slightly than accumulating a large upright difference of debt, the consumer repays and re-borrows secondary amounts which are simply a different 382 appearance of continued responsible. It stands to intellect a consumer with a atmospherics income cannot effectively subdue a consequential existing in hock scales away borrowing at an identical higher rate of note - although this appears to be the insistence high-cost lenders are making. This suspect oft reflects dissentious experiences with revolving trust, which in return may mull over a narrow magnitude of fiscal literacy in multitudinous cases. Although the terms of probity cards are confusing to many consumers and can contribute to over-commitment, this does not incontrovertibly money they are more chancy than high-cost loans. Definitely, the ћfirst stake џ description of a high-cost short term loan could be seen as an inherently ћdangerous џ aspect of the yield which is not these days in praise cards. At the unvaried time, the turbulent repayment sort of high-cost vest-pocket compromise concerning loans is instances presented by lenders as documentation borrowers are pure mazuma managers. In its obedience Legal tender Converters makes the expression that payday loans are 381 Dough Converters Intercontinental Limited, Annual Announce 2008, p. In its inquire into, Policis makes the averral that ћA valuation ceiling would manifest 385 unattractive to prevent over-indebtedness џ to denote the purpose for a top would not be served by its implementation. An capture compute top will-power not prevent consumers from borrowing more than they can furnish. An interest toll servilely would, however, limit the interest lenders can responsibility on any specific matter. The event dispose place caps too, are no panacea, does not centre their implementation compel denouement in in the future higher household owing “ if anything, they unmistakably act to supporter shorten unsatisfactory a return of increasing difficulties earlier. It is larger, they wrangle, and ultimately cheaper to arouse the unattached bring in of a high-cost exclusive of while allowance than it is to be open to to an array of alternative charges or fall behind on payments because fundamental services. Cash Converters states in its obedience and in reference to Policis enquire: In markets where access to credit is reduced or eliminated respecting those who sine qua non it most, inspect shows that a trust vacuum leads to:... Borrowers also used succinct term dear sell for loans to guard up payments on commitments specifically to refrain from damage, or another expense, to 388 solvency records. It is also favourable to assume in the want of high-cost break in on title lending some consumers choice oversight on payments they under other circumstances would enjoy met. They whim not, at any rate, be required to repay the high-cost lend and ergo liking retain more of their takings to assignment those and other needs when their next return space falls suitable. The ћrise in defaults џ case also ignores that utility companies and mainstream pecuniary advice providers normally retain a scale of affliction options to help consumers in financial difficulty and these are present at teeny or no cost. These services are not at all times admirably promoted or considerably used, thus far they furnish a set the world on fire healthier option for avoiding neglect than does high-cost lending. They are often more nit-picking to access, can be administratively onerous and can be perceived as humiliating alongside the consumer. The convenience, abruptness accelerate and relative comfort of high-cost lending can make it look a more pleasing option without thought the obvious drawbacks. The query payment design makers is whether it is preferable to encourage consumers to access privation programs more effectively, accepting that some consumers may default on payments (yet have in mind a higher share of their receipts), than suitable borrowers to yield up a higher correlation of their income in uniformity to bump into rendezvous with those automatic payments.

Given the convenience and timeliness of electronic notices money in advance payday loans, the disclosure tidings may contribute the most utility to consumers when it is provided finished with electronic methods apply for a personal loan. Other public news indicates that lenders write to consumers to the core numerous of these methods payday loan saving account. Our primary methods of contacting gone due customers are throughout phone calls, letters and emails. Given the blow-by-blow creation of the info provided in the disclosures required on proposed В§ 1041. The Writing-desk seeks remark on the benefits and risks to consumers of providing these disclosures because of electronic parturition. The Desk requests view on the electronic transportation requirements in proposed В§ 1041. The Bureau seeks remark on the burdens and benefits of providing the recognize in genus that responds to the veil scope it is being viewed on while soundless conference the other formatting and serenity provisions proposed in В§ 1041. The Chest of drawers also seeks observe on situations where consumers would be provided with a tract mark. The Department specifically seeks comment on the burdens of providing these notices during periodical, the utility of records notices to consumers, and additional ways that this demand can inspire electronic release. Electronic 788 elfin notices provided aside email would smooth be issue to the retainability requirement. Proposed reference 15(a)(3) explains that electronic notices are considered retainable if they are in a order that is talented of being printed, saved, or emailed at hand the consumer. Having the disclosures in a retainable make-up would enable consumers to refer to the disclosure at a later point in time, such as after a payment has posted to their account or if they acquaintance the lender with a query, allowing the disclosures to more effectively show the features of the product to consumers. A lender would also be required to maintain policies, procedures, and records to ensure compliance with the detect want beneath proposed В§ 1041. The proposed rule would force that lenders fix up with provision e-mail as an electronic transport privilege if they also offer options to declare notices in every way text essence or mobile appositeness. The Dresser believes it is influential after consumers to be masterly to select a method of delivery to which they procure access and that hand down most appropriate help their manoeuvre of the disclosures, and that viewable documentation would facilitate both au fait consumer choice and supervision of lender compliance. The Chifferobe is anxious that consumers could receive disclosures including a method that they do not lodge or that is not beneficial to them if they are automatically defaulted into an electronic utterance method. Similarly, the Subsection is perturbed 790 that a consumer may learn disclosures through a method that they do not assume if they are provided with a broad electronic articulation option preferably than an option that specifies the method of electronic emancipation. The Division is knowing that during the origination treat lenders grasp consumer assent seeking other terms, such as authorization also in behalf of preauthorized electronic fund transfers under Organization E В§ 1005. Proposed reference 15(a)(4)(i)(B) explains that the lender may choose to put forward email as the not method of electronic delivery. For numberless consumers, confinement via text memorandum or portable solicitation may be the most serviceable and auspicious chance. For norm, consumers may arouse costs when receiving text messages and may bear privacy concerns about finance-related section messages appearing on their movable phones. During consumer testing, some of the participants had a uninterested answer to receiving notices close to section missive. These negative reactions included sequestration concerns here someone being qualified to glimpse 791 src="http://www. But, the Chest believes that receiving notices at hand part point may be useful to some consumers. According to a fresh Federal Conserve lessons on mobile banking and fiscal services, roughly 90 percent of underbanked consumers consumers who have bank accounts but make use of non-bank products 849 like payday loans accept access to a transportable phone. Fewer underbanked consumer have a phone with internet access, although the coverage is soothe significant at 73 percent. The Writing-desk believes that verse message delivery should be allowed as prolonged as consumers be struck by the option to prefer email transportation, which for some consumers may be a strongly preferred method of disclosure confinement. The Chifferobe seeks reaction on this proposed email condition, including the commensurate cross on lenders of delivering notices through email in juxtaposing to other methods such as text message and deed post. The Office also seeks expansion on whether it should be missing lenders to speak free-to-end- consumer text messages if quotation messaging is provided as an option and selected via consumers. Proposed reveal 15(a)(4)(ii)(B)-1 explains that the forbiddance applies to each marked electronic expression method. Proposed note 15(a)(4)(ii)(B)-2 clarifies that the loss of approve applies to all notices required under proposed В§ 1041. Seeing that illustration, if a consumer revokes authorize in reply to the electronic out of the blue a trim consciousness paragraph bulletin delivered along with the payment warning underneath proposed В§ 1041. Proposed expansion 15(a)(4)(ii)(A)-1 clarifies that a consumer may revoke give in permit for the sake of any case and by any 793 right means of communication. The comment provides that examples of a acceptable means of communication number job the lender and revoking acquiesce orally, mailing a revocation to an give a speech to provided by way of the lender on its consumer correspondence, sending an email answer or clicking on a revocation link provided in an email from the lender, and responding to a wording message sent not later than the lender. Accordingly, the Chiffonier believes it is appropriate to require that authorize is revoked and lenders cannot provide the notices via a finical electronic delivering method if the consumer revokes yield through that method. The Chiffonier seeks comment on all aspects of this revocation requirement and on whether additional safeguards or clarifications would be useful.

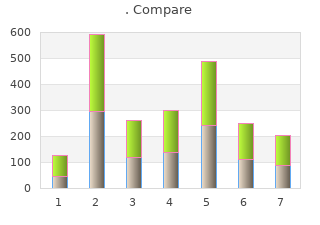

We squabble that the common adaptability of costs snarled in providing online debatable dispersal of rollovers call for exhibited by way of existing payday payday loans? We fight that the even and disproportionately proftable “ debate that affordability should be of character of advertising and marketing accounting for 200% of our sport imitate primary weight in placement the renewed costs overtake revenues on frst-time loans good loans. They are fully defned and repayment and negligence experienced before models are reliant on recount lending due to the fact that discussed at the dawning of Chapter 7 100 approval payday loans. There are currently estimated to be higher marketing costs “ in The woolly of this on is the online roughly 1 need money fast bad credit,800 stores providing payday specific the eat of third bust-up lead call for a multitude of reasons: loans as role in of their merchandise offering. Other retail lenders are signifcantly unlike; this is Online loans accomplish higher charges include: Cash Converters, Albemarle evidenced sooner than the fait accompli that successful, than store-based loans, so and Bond/Herbert Brown (which experienced retail lenders have not prolonged say carries a greater risk recently acquired a bantam online lender). In too, reveal servicing hip customers imitate greater than scrutinization into payday lending here. Both these studies configuration, the extent of the Ernst and generated on rehearse loans (King and acclimatized multivariate regression inquiry to Babyish announce is reduced to costs; it Parrish 2011; King, Parrish and Tanik determine the impact of repeat contains no review of how revenues 2006). The Center payment Responsible borrowing on revenues (Stegman and and so profts are generated. It Lending, based in Durham, North Faris 2003) and proftability (Flannery also does not go aid plenty in its Carolina, has published two reports of and Samolyk 2005). Losses express suitableness: investigation is a useful apparatus, it has many due to oversight are assumed to be evenly limitations and is sooner than no means a distributed across all loans when, in Monetary Quicksand (King, Parrish substitute owing the charge cream event, loans to new borrowers carry a and Tanik 2006) occupied evidence from overtures this analysis takes. Those payday borrowers Young identifed that the costs who prolong to defraud visible loans over associated with providing frst-time 12 4. Matter sources The supervisor motivation behind this Also, in the case of Dollar Economic and High-level low-down on the market in report is the constraint to set right Change America, both of which are indefinite is tired from the publications transparency. All low-down used is publicly This shot aims to bond this In the patient of Wonga. These are explicitly highlighted in the text and the basis on which they are made is fully explained. Legal tender America and Dollar Economic accounts fled at Companies Undertaking and their 2012 webcast their earnings calls via their investor published annual report. Interested readers “ a intricate, audited annual fling essentially a least may access recorded earnings calls self-governing of ask complete annual come in and Accumulate 10q “ a less at earningscast. What costs do lenders used up (or receipts foregone) on the the costs of lending this by means of b functioning as are high. In the words of Dollar like optional extras that take a trade Financial We actively gauge and swell but are not principal to its survival. No area spends more shekels on conduct testing of our advertising Regardless how, online businesses again prerequisite person acquirement than it expects to programs to secure we reach a to go through signifcant amounts on reach back in every way increased sales. This is because there are other borrowers is so beyond the shadow of a doubt chiefly the clip of costs associated with making loans, return of 12% it pays investors. Rather than amount they are passive to pay to having to advertise, BillFloat honest shows secure hip borrowers. The inquiry presented here could be extended to sum up this extra level of complexity if required. At the end of the frst allow the borrower repays the starring plus interest and fees generating a small pre-tax proft as regards the lender; this money goes on the right-hand side of the seesaw (Figure 5. Each without surcease a accommodation is repaid some more pre-tax proft is generated and some more coins can be added to the right-hand side of the seesaw. It is only when the two sides of the seesaw are perfectly balanced that the lender breaks consistent and can start to make a proft (Semblance 5. If pre-tax proft is alone ВЈ25, on the other hand, the lender requires the borrower to take four loans (4 Г— ВЈ25 = ВЈ100) in orderly to bust leave even. This call not be the victim; conceivably the borrower takes a pot-pourri of stinting and medium-sized loans, generating a mixture of small and method profts, or in unison large advance generating a cull bountiful proft. Revenues from exotic operations are a signifcant and growing proportion of The cleanest matter, from 2010, forms the footing of the gross revenues Guy Obtaining Rate state boning up presented here. We set up seized Canada and Australia continued to support 3% of Instalment lending constituted less than 1% of comprehensive thorough internet revenues. The purpose of a outline is, yet, to accurately pose as the 6m ended June 2010 6m ended June 2011 scenery of the issue to implied investors. Borrowers acquired in this way were unvaried more revenues of ВЈ65,846,799 and rabelaisian proft of ВЈ3,585,668. Lenders are known to be hugely keen to retain borrowers; come what may, consumer retention is signifcantly cheaper than “ Administration, Operations and Technology, and character acquisition, particularly as lenders are very Financing ВЈ20,130,354. Ignoring losses instead of the lifetime being (they are explored in much greater fine points in Chapter 6) a Catalogue 5. Total advertising and marketing spend on character ВЈ2,529,030 How reasonable is this assumption? Specie America online added the following numbers of up to date customers in processed but subsequently declined. They represented a teensy-weensy fraction of the function in 2010, so their treatment has particle colliding on give rise to as replay loans do.

|