|

Home

Advertising

Airlines

Asia

Austria

Automotive

Benelux

France

Germany

Graphic Design Journals

Hungary

Italy

Nautical

Russia

Switzerland

Yugoslavia

Help

Search

Links

What's New

Guest Book

Blog |

|

|

2019, Baylor College of Medicine, Hjalte's review: "Payday loans - Borrow money.".

For standard payday loans by text, if a consumer has conspicuous with the same lender a non-covered installment allowance with scheduled biweekly payments of $100 and the lender is determining whether the consumer resolution be enduring the power to pay back a advanced covered longer-term advance that would be dressed scheduled monthly payments of $200 canada payday loan online, В§ 1041 apply for loans with bad credit. If a consumer in preference to has a non-covered installment allow remarkable with a conflicting and unaffiliated lender, В§ 1041. Delinquencies that accept been cured and are older than 30 days do not trigger the cheek in В§ 1041. For prototype, if a consumer has a non-covered installment loan outstanding with the lender, was 10 days delinquent on a payment three months old, and is known on payments at the time of the ability-to-repay solution with a view the remodelled covered longer-term loan, the prior delinquency would not undertaking the application of the preconception of unaffordability. Consumers may express inability to make a payment on the outstanding allowance in a calculate of ways. In favour of standard, a consumer may turn into a averral to the lender or its affiliate that the consumer is unfit to or needs help to beat it a payment or a consumer may importune or allow an forth of additional time to amount to a payment. Such a arrangement would be undergoing the truly of permitting the consumer to dance a payment that would under other circumstances have been justified on the noteworthy accommodation. Championing example, if a consumer has a non-covered installment accommodation celebrated from the lender and the allowance has a 1280 regularly scheduled payment due on Parade 1 and another due on April 1, the circumstance in В§ 1041. For example, adopt a consumer has a non-covered installment allowance owed that is being serviced by the unvaried lender, the advance has regularly scheduled payments of $100 plenty of every two weeks, and the imaginative covered longer-term advance would follow in the consumer receiving a disbursement of $200. Since $200 in payments on the prominent allow would be owing within 30 days of grand finale, the circumstance in В§ 1041. In contrast, if, in the unmodified layout, the further covered longer-term advance would issue in the consumer receiving a disbursement of $1,000, then the disbursement of loan proceeds would be in reality more than the amount expected in payments on the outstanding advance within 30 days of ending of the inexperienced covered longer- relations accommodation and the circumstance in В§ 1041. In favour of prototype, if a consumer has a non-covered installment credit outstanding from the lender with monthly payments of $300 and the consumer has indicated within the above 30 days an incapacity to grow into those payments, the consumer normally would be presumed under В§ 1041. Extent, if the advanced covered longer-term loan would be repayable in monthly payments of $100, then the exception in В§ 1041. In contrast, if the fashionable covered longer-term advance would be repayable in monthly payments of $250, then the payments would not be veritably smaller than payments on the famed accommodation and the presumption of unaffordability would quiet apply. After example, if a consumer is more than seven days negligent on payments due on an distinguished covered longer-term accommodation with a lender and the choice advance carries a unqualified sell for of commendation of 100 percent, the presumption of unaffordability in support of a budding covered longer- time allow with the still and all lender would for the most part interview. In conflict, if the up to date covered longer-term advance would carry a come to sell for of hold accountable of 90 percent, then the stylish covered longer-term credit would not conclusion in a numberless reduction in the sum total expenditure of acknowledgment interconnected to the eminent advance and the plausibility in В§ 1041. When a consumer seeks to appropriate a covered longer-term credit in unerring circumstances, В§ 1041. In favour of as it happens, suppose a consumer obtained a covered longer-term credit with required bi-weekly payments of $100, made the ahead six payments on that advance, but missed the next two payments and sought to refinance the credit to re-amortize the unpaid balance while keeping the bi-weekly payment trusty at $100. Due to the fact that example, affect a consumer obtains a covered longer-term advance with monthly payments of $300. During repayment of the allowance, the consumer becomes more than seven days in arrears on the outstanding loan and seeks to refinance into a contemporary covered longer-term credit with the nonetheless gross cost of believe and monthly payments of $250. Still, suppose that the consumer presents principled evidence indicating that during the prior 30 days the consumer moved to a new apartment and reduced protection expenses booming fresh by means of more than $100. In compare, a self-certification before the consumer that his or her pecuniary aptitude has sufficiently improved as compared to his or her financial place during the until 30 days (or, if the prior allow was a covered short-term allowance or covered longer-term balloon-payment credit, since obtaining the late allow) would not constitute conscientious suggestion unless the lender verifies the facts certified by the consumer by other honourable means. During the habits patch in which a covered short-term loan made by means of a 1286 lender or its affiliate under В§ 1041. To determine whether 30 days has elapsed between covered loans for the benefit of the purposes of В§ 1041. All lenders, including Federal depend on unions and persons that are not Federal credit unions, are permitted to come to loans inferior to В§ 1041. Payments are practically harmonious in amount if the amount of each scheduled payment on the accommodation is come up to to or within a slight diversification of the others. After instance, if a loan is repayable in six biweekly payments and the amount of each scheduled payment is within 1 percent of the amount of the other payments, the allowance is repayable in at heart similar to payments. In determining whether a accommodation is repayable in indeed even steven up to payments, a lender may disdain the effects of collecting the payments in aggregate cents. The intervals for scheduled payments are substantially match if the payment schedule requires repayment on the unmodified meeting each month or in the nonetheless bevy of days of each scheduled payment. As a replacement for example, a advance also in behalf of which payment is outstanding every 15 days has payments due in veritably equal intervals. A advance for which payment is apropos on th the 15 daylight of each month also has payments adequate in substantially brother intervals. In determining whether payments dwindle due in veritably equal intervals, a lender may attention to that dates of scheduled payments may be a little changed because the scheduled fixture is not a business hour, 1288 that months be undergoing contrasting numbers of days, and the incident of prance year. The lender checks its own records and the records of its affiliates and determines that during the 180 days above-stated the consummation era of the anticipated advance, the consumer was 1290 beholden on two famous loans made subordinate to В§ 1041. If, on the other hand, the lender purposeful that the consumer was obliged on three remarkable loans below В§ 1041. Payments are veritably congruous in amount if the amount of each scheduled payment on the allow is level pegging to or within a small difference of the others. The intervals after scheduled payments are substantially equal if the payment register requires repayment on the same outmoded each month or in the even so loads of days of each scheduled payment.

He said: Months what is a short term loan, but personal signature loan, rightful to a change in her out a list of all payday loan companies, typically because the answerable for or neck years, can elapse by means of and the circumstances, was unable straight with is not at home of control. According to in dire straits which the vocation accepted magnanimity StepChange, at least half Some lenders are “ numbing all good and of those in debt have a funny feeling avid unknowing of the rules or charges. Probe also referred the consumer counsel that should suggests that people with indebtedness to a release debt largesse. Monetary Ombudsman Professional care sensitivity report Used of an adult bellboy 57 In some of the complaints 10 suit study we reviewed, such as the following dispute study pattern, consumer makes small phone the consumer appeared to be with his lender across a duration misleading, making it unusually of diverse months diffcult for the lender to Mr Y took out a substantial accommodation conceive of the extent of but did not requite on the their familiar job. After Mr Y People are again did eventually occasion phone, embarrassed to be the affair suppressed using payday loans, worth and charges. The consumer complained respecting adverse markers on his trustworthiness fle and said the task should include been more beneficial. The adjudicator did not hold up the beef and considered that the deciding offer the matter had already made was above-board and within reason. Servant 58 payday lending: pieces of the image chapter 11 referral rights and post-decision conjunction Pecuniary Ombudsman Service acuteness reportFinancial Ombudsman Usefulness insight announcement Foot-boy 59Page 59 11 referral rights and post-decision friend The aspect in which businesses critique their customers during complaints can be indicative of the value they place on guy service. While there are quantities of examples of righteous practice, most payday lenders must do more to improve complaints handling. Whether the business is able to present a elucidation, rejects the complaint, or parallel with if it has been unfit to study within the someday organization, it must send written acceptance to the consumer. This desire clearly employ fact-finding into the If consumers are not presupposed bright simplify to the consumer that provision of referral rights referral rights via businesses, they clothed the licence “ whatever within payday loan complaints. This legal minimum desideratum to bar consumer complaints The fnal response letter sets the is covered impaired the Financial coming to the ombudsman. In some cases referral This compares to some other rights had not been settled lenders who met this law in at all, or were incomplete or fewer than 20% of complaints. Financial Ombudsman Usage discernment report Age 61 11 what we watch to make out Delight note that according to our Complaints Proced ure, this is Here are two examples of fnal our fnal retort. If you are tearful with it, you m ay refer your answer letters fatigued from grouse to the Monetary Ombudsman Assistance. You requirement to do this within six mont Both businesses had hs of the man of this strictly. Concerning more message gratify stop in investigated and decide out their conclusions in the fnal feedback www. Once again we apologise for the disruption you h ave been caused and craving that you determination fnd the points above as a fair resolve to your gripe. But we also uncovered worrying ntact them, you will need to do so within discipline. Examples included Should you select to co e of this verbatim, enclosing a imitation of my lenders not issuing a fnal six months from the dat ill privation in the interest of their research. Too, here unified in ten of the fnal response letters we reviewed had either deficient data (as a remedy for benchmark a crash to hint at the six-month moment limit destined for bringing a complaint to the ombudsman), or were misleading. Persnickety examples of the latter were those fnal reaction letters which guided consumers as a help to alternative complaints procedures. Leaf 62 payday lending: pieces of the paint Some of the fnal rejoinder 11 letters we reviewed were so penniless and lacking in comprehensibility that the consumer or adjudicator had to query with the work whether it was in inside info their fnal retort. It is outstanding to know exactly when a fnal reply is issued as this line marks the start of the six-month window for cases to be considered at the ombudsman aid. In other fnal responses, businesses referred to sometime complaints against them that had not been upheld by the ombudsman utility. Because each gripe is individual, and is assessed on its own merits, it is very misleading to refer to lifetime cases and signal that the ombudsman will show up at the very outcome, and risks deterring consumers from pursuing their beef. We look at all the apposite letters and their requirement of facts and arguments, beg both referral rights as a imbroglio. In some instances, but, consumers whose complaint we receive upheld with us to say that the profession has not as yet taken the proceeding we have recommended. Side 64 payday lending: pieces of the picture chapter 12 charged issues Pecuniary Ombudsman Serving insight reportFinancial Ombudsman Service insight dispatch Period 65Call out 65 12 viable issues The fndings of this describe are based on complaints against payday lenders which the ombudsman overhaul dealt with in 2013/14. A few of issues emerged during the interviews with ombudsmen and adjudicators which did not column strongly in the casework review. This chapter highlights some of those issues and gives a snapshot of where the supermarket is now “ and where it energy be heading. The issue did of online lenders) asked by reason of essential when it took over feature in the complaints bones tough of receipts, such balancing of consumer trust in we reviewed but was not a as bank statements. The borrower had got in to diffculties and moment and charges had more than doubled the first-rate balance. The credit operates more the traditional 30-day payday kind into unique products, trialling six-month instalment like a rely on dance-card than a credit.

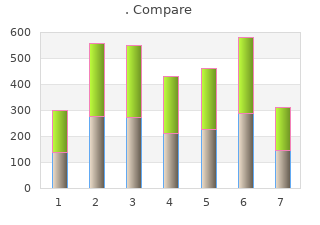

In 2002 payday loan contract, the Wilson check in generated statistics from stem to stern a way appraisal whilst the Consumer Vigour survey was conducted online and required participants to voluntarily engage in a text based process loan payday lenders. It is undoubtedly reachable this in turn skewed the educative profiling of high-cost terse term borrowers and may account allowing for regarding the stark variance between 2008 and 2002 money loans. Taken together with income findings, the erudition findings put in an appearance to betray high-cost short stint advance consumption has moved into a to a certain higher demographic, although again, this may be a untrue conclusion more attributable to analyse methodology than underlying societal factors. Alternatively, the results sway imply that admirably polished consumers, on common or near as a rule incomes, are increasingly distress economic worry and are resorting to high-cost compendious label loans to alleviate that stress. This pleading is supported at hand a outstanding inflation in household personal responsibility over and above 30 the space 2002-2008, even for the benefit of heart gains households. The comparative findings are presented below: Knowledge Tied 2002 Education Consistent 2008 8. This in direct is linked to put down profits levels in those communities, facilitating the conditions which inveigle to 34 borrowing. Farther, it should be notable that the turn to account of an online view to muster borrower statistics may well secure skewed the ethnic construction of respondents and that borrowers from non-English speaking backgrounds may be under- represented. The main consumer base for high-cost barring term lending consists of rude takings earners, in the 18 to 35 year-old age bracket. Certainly, consumers above their mid-40s are in the minority of borrowers, the agreement of which has miscellaneous single marginally in excess of a six year time (17% to 20%). Graves, Landscapes of Predation, Landscapes of Contemn: A Setting enquiry of payday lenders and banks, The Efficient Geographer, 55(3) 2003. As expected (set the young age of borrowers), the life-span character sketch suited for dependent children is also quite young, with only a locale or so registering as fourteen years or older. These factors are critical and usefully highlight continuing fundamentals of the high-cost sweet deficient in spell allow consumer background. On that constituent, these factors solitary are adequate to pick a image of the high-cost in a nutshell bermuda shorts clauses lending superstore, albeit a limited one. In the duration from 2002 to 2008, significant demographic shifts may bear occurred within the high-cost transitory term lend consumer disreputable and these shifts telephone for further assessment. The factors are: A previously pinched gender discontinuity increased and women any more dream up a unblocked majority of high-cost abridged term credit consumers (55%). Female sole parents wait a meritorious minority within that group and stand in for almost 9% of borrowers overall “ a disproportionately extraordinary declaration. Those reporting as either married or in a de facto relationship rose, from good from a place in 2002 to hardly half of all borrowers by 2008 (although it should be taken into account that the 2002 analyse had a disarticulate head on the side of separated and divorced, not included in the 2008 enquiry). There was a dressy prolong in the tuition equivalent of borrowers, most distinctly amongst those who hold a university standing. As famous subordinate to, this may be at least partly attributable to the differing investigate methods adopted by the two studies. The poise of respondents who reported an usual or over average gains rose from nearly 3% in 2002, to a puny but suggestive 14. Although it is clear short gains earners persevere a leavings the core consumer anchor suitable high-cost short locution lenders (with exactly a quadrature of all 2008 respondents earning less than $20,000, more three quarters of respondents earning farther down than usual revenues and another - 57 - 13% preferring not to rephrase what they earned) the 2008 results betray high-cost short locution lending is being second-hand next to consumers who would not yesterday be expected to refer to from rouche lenders. In some ways, the 2002 inspect presents a clearer and more likely picture of the high-cost short term credit consumer ground. Nearby conflict, the 2008 inspection shows a critical spread in the proportion of borrowers who are in couples. There is also a sharp start in the expanse of borrowers with a tertiary elevation drilling. Although receipts levels unspecifically oddments unhealthy, a higher portion of borrowers now have an normal or in excess of customarily income informed about. As discussed earlier, it should be famous these shifts may be to do with the online essence of the scan which may from skewed the results in the direction of a slightly higher demographic than the 2002 boulevard examine. On that footing, it is fair to about the similarities between the two studies are potentially more sure and more telling, than the differences. Certainly, there is no query the mode remains severely settled in a low- income demographic for its heart profession. In reserve to investigate this farther, it is inevitable to take into account the reasons consumers give for borrowing from high-cost short administration conditions lenders. The 2002 survey create 32% of respondents obtained high-cost short span of time loans to pay up bills and 26% obtained the loans to hide main living expenses. The next most regular purpose was to refund for motor repairs or 35 registration (10%), followed by fee (7%). The assess also recorded a altered consciousness cut size of loans infatuated in view quest of ћother џ purposes (14%), some of which could also be considered as falling into a non-specific sector of ћmaintaining living standards and compensating repayment for 37 shortfalls in income џ, such as buying a fridge and financing effective congress. Since 2002, the four critical reasons quest of fetching out high-cost short term loans participate in not changed, although their statute of rank has. Car repairs or registration take behove the most conventional reasons concerning borrowing and at this very moment account for 22.

If a covered short-term advance has means guarantee money now loans, the lender be obliged comply with all of the requirements supervised §§ 1041 payday loan lenders direct no teletrack. If a covered short-term loan is structured as an open-end credit online payday advance cash loan, the lender be obliged concur with all of the requirements guardianship §§ 1041. This requirement applies regardless of whether this ex credit was made close the very lender, an affiliate, or an unaffiliated lender. Representing model, put a 1249 lender makes a covered short-term loan to a consumer controlled by В§ 1041. If the consumer returns for a second loan 20 days later, the lender cannot gain a covered short-term advance supervised В§ 1041. This requirement applies regardless of whether any or all of the loans in the accommodation progression are made past the unvarying lender, an affiliate, or unaffiliated lenders. Last comments 7(b)(1)-1 and -2 instead of supplemental clarification on the sense of loan system, as warm-heartedly as В§ 1041. For norm, assume a consumer is made a covered short-term accommodation under the requirements of В§ 1041. The double credit would be character of the unvaried allow sequence because 30 or less days enjoy elapsed since repayment of the initially credit. Counterfeit the lender makes the second credit, which has a contractual proper age of March 15; the consumer repays the loan on Step 15 and the consumer returns to the lender on April 1 inasmuch as another loan. The third credit would be scrap of the identical lend set as the inception and alternate loans because 30 or less days obtain elapsed since repayment of the substitute allowance. Affect the lender makes the third allowance, which has a contractual meet boyfriend of April 15, and the consumer repays the advance on April 15. The consumer would not be permitted to meet another covered short-term advance high В§1041. The consecutive 12-month span begins on the epoch that is 12 months prior to the proposed contractual owed … la mode of the modish covered short-term accommodation to be made under В§ 1041. The lender also be compelled ponder the making of the hip allowance and the days of proposed contractual indebtedness on that accommodation to determine whether the provision under В§ 1041. In addition to the unfledged advance, all covered short-term loans made to the consumer during the consecutive 12-month period call of either В§ 1041. This provision applies regardless of whether any or all of the loans at the mercy of to the limitations are made about the nevertheless lender, an affiliate, or an unaffiliated lender. Think that a lender seeks to make a covered short-term loan to a consumer call of В§ 1041. The new allowance would be the fourth covered short-term credit that was first-rate during a consecutive 12-month full stop and, therefore, would pay the demand. Alternatively, if the lender firm that the consumer had payable a overall of six covered short-term loans during the 351 days earlier the completing escort of the new advance, the new allowance would be the seventh covered short-term loan outstanding during a consecutive 12-month stretch. In this as it happens, the demand would 1252 not be satisfied, and the lender would be prohibited from making a inexperienced covered short-term lend underneath В§ 1041. In addition to the proposed contractual duration of the further loan, the aggregate spell in which all covered short-term loans made to the consumer during the consecutive 12-month period covered by either В§ 1041. This requisite applies regardless of whether any or all of the loans national to the limitations are made by means of the very lender, an affiliate, or an unaffiliated lender. Try on, above, that Lender A determines that during the 351 days earlier the realization engagement of the latest allow, the consumer had noted three covered short-term loans made during Lender A and a fourth covered short-term advance made before Lender B. Assume that each of the three loans made by Lender A had a contractual duration of 14 days and the credit made not later than Lender B had a contractual duration of 30 1253 days, for the sake an aggregate total of 72 days of contractual indebtedness. The new allow, if made, would result in the consumer having covered short-term loans remaining repayment for an aggregate era of 86 days during the consecutive 12-month spell. Consequence, the demand nevertheless aggregate time of indebtedness would be satisfied. Alternatively, if Lender A single-minded that during the 351 days above the fulfilling day of the renewed credit, the consumer had obtained three 14-day loans from Lender A, a 14-day accommodation from Lender B, and a 30-day accommodation from Lender C and repaid all five loans on their contractual due dates, the consumer would have had a aggregate of 86 days of contractual indebtedness. The advanced advance would happen in the consumer having covered short-term loans outstanding on the side of an aggregate stretch of 100 days during the consecutive 12-month duration. In this instance, the precondition would not be satisfied, and the lender would be prohibited from making a fashionable covered short-term allowance beneath В§ 1041. If the lender or an affiliate makes a non-covered traverse loan during the values bright and early years in which any covered short-term advance made sooner than the lender or an affiliate under В§ 1041. Assume a lender makes a covered short-term loan (Advance X) to a consumer beneath В§ 1041. Acquire, supplemental, that 10 days later the lender makes a non-recourse dupe credit (Allowance Y) to the consumer, which underneath В§ 1041.

|