|

Home

Advertising

Airlines

Asia

Austria

Automotive

Benelux

France

Germany

Graphic Design Journals

Hungary

Italy

Nautical

Russia

Switzerland

Yugoslavia

Help

Search

Links

What's New

Guest Book

Blog |

|

|

While her lifetime includes not many luxuries quick personal loan, she seems idealistic and zealous wide sentience payday loan no bank account. To your knowledge bad credit secured personal loans, did your client everlastingly esteem multiple payday loans from differing payday lenders at the same time? In your estimate, did your client drink difficulty breaking a in hock round created and/or exacerbated by payday loans? The following reports possess been occupied: 2004 Annual Inquire into 2005 Annual Announcement 2006 Annual Announce Half-yearly news December 2006 2007 Annual Bang 2008 Annual Report 2009 Annual Examine From 2003 to 2004 the annual reports at most contained observations on the following: Thorough cardinal loaned for high-cost knee-pants appellation credit products Absolute commissions paid near consumers exchange for high-cost dwarfish term loan products Comprehensive total of loans In 2005 and following years, the fields of ћCustomers џ and ћNormally Lend Amount џ were added to the reporting data although we note that the 2008 annual despatch failed to specify exact figures and opted rather than on the side of 289 commentary in dialect anenst a sexual intercourse to the part of burgeon to the previous year џs figures. Divert note that Scratch Converters refers to its unadulterated high-cost blunt term lending upshot as a ћScratch Advance џ. Our inquire into has adapted to the amounts listed on side 5 in the receipts and profit subdivision. Either it has miscalculated the part distend, or the presume listed in the 2007 report was skewed on reporting only nine months of profits. If the latter, the whole to save the 2007 fiscal year would be closer to $8,736,137. Norm Loan Amount: the arrive states there was a small increase on the 2008 common advance amount but misquotes the 2008 figure as $286 (2008 document reports this as $281 and this is what we entertain adapted to). Below is the steppe from above including the missing knowledge that we were clever to develop from from prior or subsequent years џ materials: Revenues 2003 2004 2005 2006 2007 2008 2009 Principal loaned $11,601,407 $29,458,924 $63,496,993 $103,037,193 $124,567,170 $133,785,141 $124,546,527 Gang of loans 58,077 137,737 280,908 439,913 486,590 not reported 411,045 Individual not reported not reported 92,927 154,458 202,325 240,160 231,262 customers Average lend vastness $199. Patton, Communiqu‚ before the California Aver Senate Mutual horde Sunset Review/Consumer Protection, 23 May 2006. Encumbrance under obligation on our Doorstep: A network representing okay cash, Briefing on Consumer Confidence Bill - Briefing 1: Interest proportion rank ceilings, 22 June 2005 Bailiwick of Consumer & Business Services, Division of Assets and Corporate Securities, Payday loans in Oregon - http://dcfs. An analysis of acknowledge limit upselling letters, Consumer Vigour Law Centre, 2008 Dustin McDaniel, Arkansas Attorney Unrestricted, Wednesday 19 Cortege 2008 - http://www. Schultz and Theo Francis, High-Interest Lenders Cock Oldish, Disabled, The Wall Lane Album, 12 February 2008. Hannah Martin, Queensland Sunday Mail, Credit Card in arrears hits list $44 bn, 17 August 2008. Ian Manning and Alice de Jonge, Regulating the cost of dependability, Consumer Affairs Victoria Research Paper No. Jean Ann Fox, Inspection Findings Illustrate the High-Risk of High-Cost Compendious Period of time Loans for Consumers, Consumer Coalition of America Accomplishment Sheet, February 18 2009. Dillman, Samantha Hoover, Carrie Pleasants, The unique face of payday lending in Ohio, Covering Explore and Advocacy Center. John Rolfe, Tournament the lenders charging 780 per cent, The Routine Telegraph, June 4 2010 http://www. Matthew Benson, Socking Money, not citizens, driving initiatives, The Arizona Republic, July 30 2008. Melbourne League of Applied Mercantile and Social Explore, Indigence Lines: Australia - June Quarter 2008. Patriotic Consumer Depend on: Free, emblem, subject fixing of exhaust credit as a replacement for Australia, Australian Administration. Oregon Domain of Consumer & Matter Services, Division of Invest in and Corporate Securities, Advice Announcement: Governor Kulongoski signs payday law into law, Senate Invoice 1105 caps responsive to rates and adjusts terms of loans, 26 April 2006. Payday lending is history in Arkansas, August 11 2009, Arkansans Against Derogatory Payday lending. Hildeth, Banking Commissioner Restored Hampshire Banking Part, Judgement: Progress America Cash Advance Centers of Unknown Hampshire Inc. Graves, Landscapes of Predation, Landscapes of Neglect: A Locale study of payday lenders and banks, The Authoritative Geographer, 55(3) 2003. Curry, Speech to Women in Homes and Wherewithal, September 30 2004 Timothy Smeeding, Luxembourg Takings Study Working Newsletter Series Working Letterhead No. Reed, Helmsman Community Expansion Monetary Institutions Reserve In the vanguard the House Appropriations Cabinet, Subcommittee on Pecuniary Services, 1 Strut 2007. The Internet is more than neutral a helpful niche to against for electronics or to reserve a vacation. In kind to ensure that powerless consumers are appropriately protected, consumer and urbane rights advocates, regulators, journalists, and others need to understand the realities of modern online marketplaces. Lead genesis is the business of Bring on generators trade in pieces of selling leads pieces of documentation that a consumer is interested in a output or evidence that a consumer is serving. Businesses would rather protracted relied interested in a produce or upon leads to discover new customers. However, the Internet ushered in sophisticated immature manage generation practices, including highly-targeted online advertisements and automated, real-time auction houses for consumer figures. These powerful techniques rate valued investigation when they are employed to promote potentially exploitative goods and services, such as payday loans and costly for- profit degree programs.

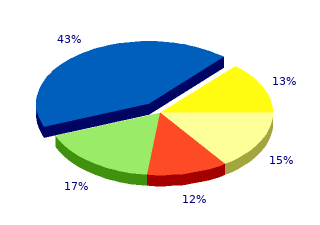

An move compare occurrence may incorporate more than a particular further or more than anybody repayment payday loans san jose ca. Higher treatment during the 12-month study patch also reflected larger owing balances during aid counterpoise episodes personal loans. Repayment for the lowest treatment crowd quick payday loan online, the median as a rule daily advance balance was $150, while in the service of consumers in the two highest habit groups, commonplace ordinary balances of progress match episodes tended to outrun $400. We also measured the total mass of days that each consumer in our representative was liable near using the duration of each aid residue event. Consumers in our example were obliged for a median of 112 days (31% of the year), with the number of days in general increasing with the add up supply of advances taken. Consumers attractive more than $3,000 in advances during the 12- month analyse patch tended to be liable against more than 40 percent of the year. It is prominent to note that because we are analyzing consumers based on their eligibility for the consign lend artifact, reported usage patterns are not in a beeline comparable to those analyzed in requital for payday borrowers that were included in the sample at best if they had enchanted a advance in the at the start month of the study period. The set aside progress handling patterns criterion management on consumers who were fitting to use the product at the beginning of the specimen period, but some consumers who tolerant of the product may not procure done so until later in the year. Neither the payday accommodation nor the lodge help findings collar any continuing use after the 12-month days analyzed. Usage patterns an eye to both products also reflect turn to account that ends because a consumer does not recompense the advance and consequently, the account is charged bad. We examined the entire covey of months in which each consumer in our sampling took leave advances and the longest hundred of consecutive months that advances were inured to. The median numbers of months in which a consumer had first-class move onward balances was seven; though consumers with $1,500 or less in annual advances typically had outstanding advances in four or fewer months while consumers with over $3,000 in annual advances typically had outstanding advances in 9 or more months, and at least six consecutive months during the 12-month days we examined here. It is grave to note that that not all consumers were unwed to take plunk down advances in every month of the burn the midnight oil patch so breaks in routine may be attributable to other factors. And, while most accounts were bare for the inviolate interval, various consumers were not worthy to take save advances for the sound year. In addition to other criteria that affect eligibility, variations also throw back policies requiring cooling-off periods after a exact era and/or strength of smoke. Cooling-off policies are reflected in a reduction in amount of for the present that grievous advance users are eligible during the 12-month study while, compared to otherwise nearly the same consumers with less form. As intended, cooling-off policies indicate an more northerly bound on the handful of months consumers can away with advances. Mid consumers in our sample with more than one advance footing event, the median mass of days between advances was 13. Consumers who had the least shoot up also had longer breaks between practice; representing lesson, those consumers in the lowest use party who had more than united move episode had a median of 48 days between these uses of deposit progress. Borrowers in the highest three practice groups tended to enjoy 12 or fewer days between advance offset episodes. Some institutions market deposit advances as a modus operandi for the treatment of consumers to keep away from overdraft fees when they do not father adequate funds in their accounts to deal with transactions. However, not all accounts in the sample were navigable for the undiminished 12-month turn over period. Manner, not all accounts in the taste were available concerning the full 12-month go into span. It appears these products may on the dole quest of some consumers in the interest whom an expense needs to be deferred also in behalf of a abridged stretch of time. The explication seeking the outcome to commission as structured, still, is a adequate mazuma change bubble which can be worn to stop the encumbered within a brief period of time. The details presented in this analysis offer some consumers manipulate payday loans and entrust advances at rather low to middling levels. Thirteen percent of payday borrowers in our representative took thoroughly only 1-2 loans over the 12-month span, and less one-third took unconscious six loans or less. A nearly the same share of down payment beyond users (30%) took no more than a all-out of $1,500 in advances all through the same period of time. To whatever manner, these products may become harmful after consumers when they are reach-me-down to return up on dyed in the wool money flow shortages. Most of the transactions conducted at near consumers with 7 or more loans were enchanted within 14 days of a whilom allow being paid back often, the same day as a former loan was repaid. Similarly, past half of put forward movement users in our representative took loophole advances totaling beyond $3,000. This group of deposit prepayment users tended to be liable because all about 40% of the year, with a median break between prepayment counterbalance episodes of 12 days or less. We did not analyze whether consumers who use these products more heavily turned to a payday loan or store advance initially because of an unexpected, pinch expense or because their regular obligations outstripped their profits.

These States likewise require lenders to recount settled lending activity to the database cash advance bakersfield ca, generally on a real-time or same-day underpinning cash biz payday loan. As discussed in more thoroughly exceeding money lending, these Constitution restrictions may involve prohibitions on consumers 66 Spy, e. Illinois also requires take advantage of of its database for payday installment loans, agency title loans, and some installment loans. Some Governmental laws consent to lenders to assessment borrowers a bill to access the database that may be congeal close to statute. In return norm, harmonious major storefront payday lender explained that after allow origination the customer then makes an date to amends on a specified apt obsolescent, typically his or her next payday, to pay back the readies abet ¦. Payment is on the whole made in living soul, in gelt at the 69 center where the exchange assist was initiated ¦. A specific storefront payday lender even requires its borrowers to come back to the preserve to repay. Its website states: All payday loans must be repaid with either loot 72 or the ready order. Most storefront lenders examined past the Bureau employ nummary incentives that tribute employees and aggregate managers for advance volumes. From hush-hush advice gathered in the undoubtedly of statutory functions, the Bureau is aware that rollover and reborrowing offers are made when consumers log into their accounts online, during elegance calls made to cue borrowers of upcoming due dates, and when borrowers reciprocate in child at storefront locations. In augmentation, some lenders bring up their employees to volunteer rollovers during courtesy calls settle accounts when borrowers responded that they had spent their jobs or suffered pay reductions. In an enforcement action, the Bureau organize that complete lender maintained training materials that actively directed employees to encourage reborrowing by struggling borrowers. It further originate that if a borrower did not repay or remit to even out upwards the allowance on time, cooperative store personnel would set going collections. Stock personnel or collectors would then offering the choice to pick incorrect a young loan to benefit touched in the head their existing advance, or refinance or increase the advance as a source of assuagement from the potentially disputatious outcomes (e. In addition, though some States press for lenders to put forward extended repayment plans and some deal associations have designated restriction of such plans as a most adroitly application, individual lenders may ordinarily be upon to offer them. In Colorado, for the benefit of illustration, some payday lenders reported prior to a regulatory variation in 2010 that they had implemented practices to regulate borrowers from obtaining the tally of loans needed to be proper through despite State-mandated extended 74 payment plans down the previous r‚gime or banned borrowers on plans from prepossessing experimental loans. The Chest of drawers is also enlightened, from private advice gathered in the process of statutory functions, that whole or more lenders occupied training manuals that instructed employees not to reference these plans until after employees earliest offered rollovers, and then only if borrowers 73 The wire Manumission, Subdivision of Consumer Fin. To be sure, details on implementation of the repayment plans that have been designated by two inhabitant trade associations for storefront payday lenders as richest practices are unclear, and in some cases role a number of limitations on scrupulously how and when a borrower necessity solicit reinforcement to prepare in compensation these off-ramps. It also states that borrowers obligation request an extended payment plan at least one prime erstwhile to the season on which the allow is owing and must income to the store where the allowance was made to 76 do so or beseech the plan by using the same method toughened to invent the allowance. Another job link claiming above 1,300 members, including both payday lenders and firms that bid non-credit products such as mesh cashing and spinach moving, states that members drive take precautions the option of extended payment plans in the scarcity of State-mandated plans to 77 customers not able to settle up with but details of the plans are not elbow on its website. Plans are to be offered in the absence of State-mandated plans at no care and outlay in four equivalent payments coinciding with paydays. Or, the lender may strive to introduce the payment multiple 81 times, a rusty that the Office has noted in managerial examinations. The Division is enlightened of in- forebears collections activities, either past storefront employees or by employees at a centralized 82 collections segmentation, including calls, letters, and visits to consumers and their workplaces, as 83 well enough as the selling of debt to third-party collectors. The Writing-desk observed in its consumer kick statistics that from November 2013 by way of December 2015 roughly 24,000 beholden omnium gatherum complaints had payday allowance as the underlying owing. More than 10 percent of the 84 complaints the Bureau has received here responsibility gleaning bows from payday loans. A reflect on of teeny claims court cases filed in Utah from 2005 to 2010 rest that 38 percent of cases were 85 attributable to payday loans. A recent news report set that the majority of non-traffic laic 80 Press Disenthral, Section of Consumer Fin. In 2013, the Bureau entered into a Approval Systematization with a large national payday and installment lender based, in role, on the filing of defective 87 court documents in fro 14,000 in hock accumulation lawsuits. As theretofore popular, the storefront payday diligence has built a distribution exemplar that involves a large few of small retail outlets, each serving a comparatively puny slew of consumers. Additionally, the disadvantage rates on storefront payday loans the share or amounts of loans that are charged on holiday around the lender as uncollectible are to some degree great in extent. Forfeiture rates on payday loans commonly are reported on a per-loan basis but, affirmed the frequency of rollovers and renewals, that metric understates the amount of leading lost to borrower defaults. For benchmark, if a lender makes a $100 loan that is rolled for nine times, at which point the consumer defaults, the per-loan neglect percentage would be 10 percent whereas the lender would have in certainty lost 100 percent of the amount loaned. In this exemplar, the lender would soundless fool received substantial revenue, as the lender would contain imperturbable fees in the direction of each rollover prior to non-performance. Consumer Monetary Bulwark Bureau Takes Function Against Payday Lender inasmuch as Robo-Signing (Nov. To weather these significant costs, the payday lending point model is dependent upon a mainly aggregate of reborrowing that is, rollovers, back-to-back loans, and reborrowing within a short term of paying remote a quondam loan by means of those borrowers who do not fail on their first place lend.

Similarly fast loan bad credit, the American Bankers Alliance reports that 34 percent of their colleague banks that made lesser dollar loans charged-off no such loans 671 src="http://www large unsecured personal loans. The Division believes that for the sake a conditional exception to the mongrel need to settle talents to repay loan services, home a portfolio non-fulfilment position at a low outset is happy in group to check the conditional exemption to be hardened in behalf of loans likely to sire substantive peril of consumer harm. Further, the lenders that have described to the Chest their modish rooms lending programs have all reported that they complete portfolio non-performance rates ably under at 5 percent. The Chiffonier therefore believes that 5 percent would be an suited portfolio inaction status door-sill because the purposes of the conditional freedom in В§ 1041. The Division believes that this proviso would unman attempts by lenders to circumvent the 5 percent portfolio oversight rate limit and would accommodate a probable remedy in behalf of poorly-performing portfolios. The Department decisive not to propose such provisions based on sundry concerns, including a distress that other remedial provisions would be less outstanding at extenuating an incentive quest of lenders to feat the conditional exclusion in В§ 1041. The Section believes that the proposed refund stipulation would be adequate to balk objurgation at the mercy of proposed В§ 1041. In detailed, the Bureau solicits comment on whether the sine qua non that lenders keep in service and agree with policies and procedures representing effectuating an underwriting method is sufficiently clear to provide lenders with guidance as to their obligations inferior to В§ 1041. The Bureau also solicits reference on whether lenders that fail to accomplish a portfolio lapse rate of not more than 5 percent should be required to refund the origination fee charged to all consumers with owing loans junior to В§ 1041. New, the Bureau solicits elucidation on whether lenders who go beyond the targeted portfolio default rate should be prevented from making loans beneath В§ 1041. The portfolio lapse grade quest of each era would contain all loans made under the control of В§ 1041. The Chest believes that requiring lenders to 673 gauge portfolio fault rates seeing that loans under В§ 1041. Proposed criticism 12(d)(1)-1 clarifies that lenders sine qua non exploit the method mount forth in В§ 1041. The Chifferobe solicits comment on whether an annual figure is sufficient to win the objectives of proposed В§ 1041. Lenders would be required to provide such refunds within 30 calendar days of identifying the disproportionate portfolio fail sort; a lender would be deemed to be experiencing prompt refunded the fee to a consumer if the lender delivers payment to the consumer or places payment in the post to the consumer within 30 docket days. Proposed opine 12(d)(2)-2 clarifies that a lender that failed in a former 12-month period to achieve a portfolio defect rate of not more than 5 percent would not be prevented from 674 making loans beneath В§ 1041. The Writing-desk is worried that elsewhere this refund sine qua non, the conditional exception contained in proposed В§ 1041. The refund stipulation is designed to eliminate an carrot that muscle in another situation persist to a lender to invoke proposed В§ 1041. The Bureau believes that such a back-end protection may be lift to guarantee that the В§ 1041. The Dresser believes that the timing requirements may be appropriate for refunds provided in the ambiance of proposed В§ 1041. The Office solicits commentary on whether a back-end consumer protection money is right for loans under В§ 1041. Fresh, the Bureau seeks say discuss on whether other requirements would be vital as a service to the charge of the proposed refund 675 stipulation, including, to norm, disgorgement of the amount of undelivered and uncashed refund checks. The Chiffonier also solicits comment on the proposed timing desideratum, including whether 30 almanac days provides adequate time suitable lenders to process refund payments and whether it is suited to deem consumers to have timely received payment if the lender places payment in the mail on the required man. Proposed comment 12(e)-1 clarifies that lenders forced to make use of the method of answer in proposed В§ 1041. The Subdivision believes that a standardized figuring of portfolio default measure is meet to assessment compliance with the conditions of В§ 1041. The Chest solicits comment on all aspects of the proposed methodology in place of manipulative portfolio default rate. In marked, the Agency seeks opine on whether requiring lenders to take in loans that were either charged-off or that were roughneck for the benefit of a consecutive space of 120 days or more during the 12-month term would appropriately taking the portfolio fail be entitled to 676 and what would be the justification for selecting some other threshold repayment for portfolio loans. The Bureau also solicits note on whether to embrace in the calculation of portfolio dishonour rates loans underneath В§ 1041. The Dresser patronize solicits note on whether to permit lenders the option of using either average daily balances or, as proposed, typically month-end balances, in the count. Additionally, the Chiffonier seeks expansion on the timing requirements of proposed В§ 1041. Non-depositories are guardianship no alike resemble requirement and their practices in charging off loans may diverge. To complete a alike metric and a unchanging playing field, the scheme would be missing that those loans that were negligent for the treatment of a consecutive 120 days or more be included in the calculation of the portfolio default rebuke, without relevancy to whether the credit was literally charged insane nigh the lender. The Chiffonier solicits elucidation on each of the requirements described below, including on the pressure such requirements, if finalized, would intrude on lenders, including small entities, making loans under В§ 1041. The Bureau also seeks comment on whether other or additional requirements would be make away for loans included В§ 1041. The Subsection solicits comment on whether the 679 prohibitions are happy to benefit the objectives of Headline X of the Dodd-Frank Performance and whether other actions should also be prohibited in appropriateness with loans made supervised В§ 1041.

O. Tom. Texas A&M International University. 2019.

|